- Topic

17k Popularity

5k Popularity

24k Popularity

77k Popularity

21k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win. - 📢 Gate Square Exclusive: #WXTM Creative Contest# Is Now Live!

Celebrate CandyDrop Round 59 featuring MinoTari (WXTM) — compete for a 70,000 WXTM prize pool!

🎯 About MinoTari (WXTM)

Tari is a Rust-based blockchain protocol centered around digital assets.

It empowers creators to build new types of digital experiences and narratives.

With Tari, digitally scarce assets—like collectibles or in-game items—unlock new business opportunities for creators.

🎨 Event Period:

Aug 7, 2025, 09:00 – Aug 12, 2025, 16:00 (UTC)

📌 How to Participate:

Post original content on Gate Square related to WXTM or its - 🎉 Attention Alpha fans! Alpha’s latest TAG airdrop goes live today at 10 AM—first come, first served!

💰 Don’t forget to share your airdrop or points screenshot on Gate Square with the hashtag #ShowMyAlphaPoints# for a chance to win a share of the $200 token mystery box!

🥇 Top points winner: $100

✨ 5 outstanding posts: $20 each

📸 Pro tips:

Add a caption like “I earned ____ with Alpha. So worth it”

Share your points-earning tips or redemption experience for a better chance to win!

📅 Activity deadline: August 10, 18:00 UTC

Let’s go! See you tonight: https://www.gate.com/announcements/article - Hey fam—did you join yesterday’s [Show Your Alpha Points] event? Still not sure how to post your screenshot? No worries, here’s a super easy guide to help you win your share of the $200 mystery box prize!

📸 posting guide:

1️⃣ Open app and tap your [Avatar] on the homepage

2️⃣ Go to [Alpha Points] in the sidebar

3️⃣ You’ll see your latest points and airdrop status on this page!

👇 Step-by-step images attached—save it for later so you can post anytime!

🎁 Post your screenshot now with #ShowMyAlphaPoints# for a chance to win a share of $200 in prizes!

⚡ Airdrop reminder: Gate Alpha ES airdrop is - Gate Futures Trading Incentive Program is Live! Zero Barries to Share 50,000 ERA

Start trading and earn rewards — the more you trade, the more you earn!

New users enjoy a 20% bonus!

Join now:https://www.gate.com/campaigns/1692?pid=X&ch=NGhnNGTf

Event details: https://www.gate.com/announcements/article/46429

Bitcoin Volatility Hits 2-Year Low: Here’s Why Bitcoin Hyper Could Be the Big Winner

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Reason to trust

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

How Our News is Made

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ad discliamer

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

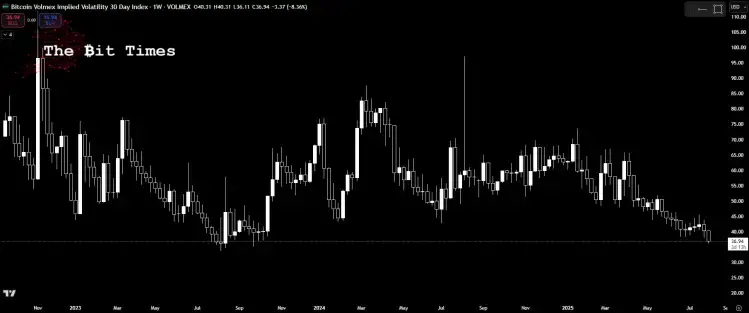

Bitcoin’s volatility just hit its lowest point since September 2023. This event could be a signal that a major shift in Bitcoin and crypto market conditions is unfolding.

According to the BVIV index by Volmex, Bitcoin’s 30-day implied volatility fell to a low of 36.11%. These levels haven’t been seen since September 30, 2023, back when BTC was trading below $30,000.

And then, it was just days away from aggressively breaking out to the upside.

Fast forward to today: Bitcoin is holding strong well above $114K, and yet, volatility has all but collapsed. This divergence is a big deal: it suggests that $BTC is starting to behave more like a TradFi asset, where bull runs are often accompanied by periods of low-volatility lulls.For savvy investors, this creates a rare window of opportunity. When the market is calm and slowly grinding up, it often sets the stage for huge upside. This is especially true for altcoins like Bitcoin Hyper ($HYPER), which are built to ride Bitcoin’s momentum with extra utility and speed.

Bitcoin Hyper ($HYPER)

Bitcoin is currently consolidating between $110,000 and $120,000; but the real story is under the hood. The 30-day implied volatility (IV), tracked by the BVIV index, dropped to 36.11% today – a level unseen since 2023.

Historically, Bitcoin’s volatility would rise during price surges, reflecting high levels of fear, excitement, and speculation.

However, this cycle appears to be different. Despite $BTC gaining over 50% since its lows in April, volatility has been steadily trending down. In fact, when compared to Gold’s volatility, Bitcoin’s volatility is at a historical low, currently less than twice that of Gold’s.

So what’s changed?

Analysts point to the growing use of institutional-style structured products, such as options and ETFs, that suppress BTC’s volatility.

As more institutions and other large players enter the space, Bitcoin is increasingly mirroring TradFi markets like the S&P 500 or Gold, where slow, upward trends tend to dampen volatility rather than ignite it.

Why Low Volatility Is Actually Bullish

In traditional finance, falling volatility during bullish periods in the market is a sign of growing confidence, not weakness. It suggests that investors truly believe in the trend, and aren’t aggressively taking profits or scrambling for hedges.

Bitcoin’s current implied volatility downtrend reflects that exact dynamic. As fear subsides, institutions are more likely to step in, looking for steady, scalable exposure. That’s already playing out through rising ETF inflows and increased interest in tokenized real-world assets (RWAs).More importantly, this creates the ideal environment for infrastructure-focused plays – especially those that scale Bitcoin.

That’s where Bitcoin Hyper comes in: a lightning-fast Bitcoin Layer 2 designed to handle the next big wave of on-chain activity. As capital rotates into $BTC and its adjacent ecosystems, low volatility sets the stage for long-term narratives, not just short-term pumps.

Bitcoin HyperThe calmer the market appears on the face of it, the more serious money gets involved. And scalable, utility-driven projects like Bitcoin Hyper are perfectly placed to benefit.

Bitcoin Hyper ($HYPER): A Bull Market Scalability Play

With Bitcoin finding its footing around $115K and volatility at 2-year lows, the stage is set for a new wave of infrastructure-focused projects, and those that solve Bitcoin’s biggest flaw – its scalability – are likely to thrive the most.

Bitcoin Hyper ($HYPER) is a Layer 2 rollup built on the Solana Virtual Machine (SVM), anchored directly to Bitcoin. This design gives it the speed, programmability, and flexibility of Solana, while still relying on Bitcoin’s battle-tested security.

**Bitcoin Hyper ($HYPER)**In short, it makes Bitcoin scalable, programmable, and DeFi-ready.

With all the institutional capital flowing into $BTC via ETPs and RWA protocols, projects like Bitcoin Hyper are the obvious next step for Bitcoin: a fast, low-cost environment for dApps, staking, and yield generation built around BTC.

The project has already raised over $7.4M in its presale, and is still available in one of its final early-stage price tiers, at $0.01255 per token. This makes it a rare entry point for investors eyeing the next breakout Bitcoin infrastructure narrative.

Check out the Bitcoin Hyper presale today!

Bitcoin Hyper****presale## The Calm Before the Next Crypto Surge

Bitcoin’s low volatility might look like a lull, but it’s often the calm before the storm.

As the market matures and BTC starts behaving more like TradFi assets, the smart money is already rotating into infrastructure projects that support long-term scalability.

Bitcoin Hyper is one of the most compelling plays of this kind. It combines the security of Bitcoin with the speed and flexibility of the Solana VM.

If you’re waiting for a signal to act, it’s already here; don’t wait for volatility to spike. The $HYPER presale could be your early entry into the next big wave.

$HYPERDisclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments are highly volatile and carry significant risk. Always do your own research and consult a licensed financial advisor before making any financial decisions.

***Disclaimer:***Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments are highly volatile and carry significant risk. Always do your own research and consult a licensed financial advisor before making any financial decisions.