Following Ethereum's resurgence, Ronin is making a powerful return to the L2 ecosystem.

On August 15, Ronin announced it would transition from an Ethereum sidechain to a Layer 2 solution. Just five months earlier, Ronin had positioned itself as a sidechain expanding into DeFi and integrating gaming and consumer Dapps. What happened to prompt such a rapid pivot?

Four years ago, Ethereum’s scaling roadmap was still nascent. Today, Ronin notes, things have changed dramatically. Ethereum’s resurgence has driven transaction costs down and speeds up to unprecedented levels. As the backbone of leading Web3 games such as Axie Infinity, Ronin’s strategic shift isn’t just a sign of Ethereum’s renewed momentum—it may also mark a new era of maturity and scalability for blockchain gaming.

A Former Winner

Ronin traces its roots to 2021, when the Sky Mavis team built it specifically for Axie Infinity, a game that became a global phenomenon. At the time, high gas fees and congestion on Ethereum’s mainnet were persistent problems for gamers. Ronin launched as a sidechain to deliver low-cost, high-throughput transactions tailored for gaming.

At its height, Axie Infinity drew in millions of players, and Ronin’s daily active users topped 1 million, fueling explosive global growth of the Play-to-Earn model.

But the boom was short-lived. In March 2022, Ronin suffered the largest hack in history, with losses reaching $625 million. The incident revealed the sidechain model’s shortcomings in security and decentralization—leading many to predict Ronin’s decline.

Nevertheless, the Sky Mavis team demonstrated extraordinary resilience. They upgraded the validator framework, adopted Delegated Proof-of-Stake (DPoS), and collaborated with Binance and others to restore the network. In August 2024, Ronin further convinced white-hat hackers to return $10 million in ETH, preventing further financial damage.

By 2025, Ronin had staged a remarkable comeback, with daily active wallet numbers holding steady near one million and vibrant activity in games like Pixels, Lumiterra, and Fishing Frenzy. According to its official website, Ronin’s on-chain DEX volume reached $9.41 billion, NFT trading volume hit $6.47 billion, TVL climbed to $750 million, and wallet downloads totaled 31 million.

The Mounting Limitations of Sidechains

The push for this transformation stems from the sidechain model’s increasing limitations. As the Ethereum ecosystem matured, sidechains delivered independence but at the cost of shared security and liquidity integration with the mainnet.

In its announcement, the Ronin team stated directly: “Ronin is returning to Ethereum as a Layer 2.” This was no spur-of-the-moment decision, but follows a clear industry trend. In 2025, Layer 1 chains including Celo and Cronos migrated to L2 architectures, highlighting how L2 inherits Ethereum’s robust security while enabling high TPS (transactions per second).

Data from the Ethereum Foundation shows L2 solutions have pushed the entire network’s TPS above 100,000, driving global adoption. Ronin’s transition will leverage zero-knowledge proof (zk) technology to develop a zkEVM (zero-knowledge Ethereum Virtual Machine), preserving full Ethereum compatibility while sharply reducing transaction costs and latency.

Ethereum’s Triumphant Return

Ronin’s decision to embrace L2 and return to Ethereum is driven in part by Ethereum’s strong comeback in Q3 2025, with ETH holding above $4,600 in mid-August—just shy of its all-time high.

The revival of confidence in Ethereum has also been fueled by explosive activity across its ecosystem.

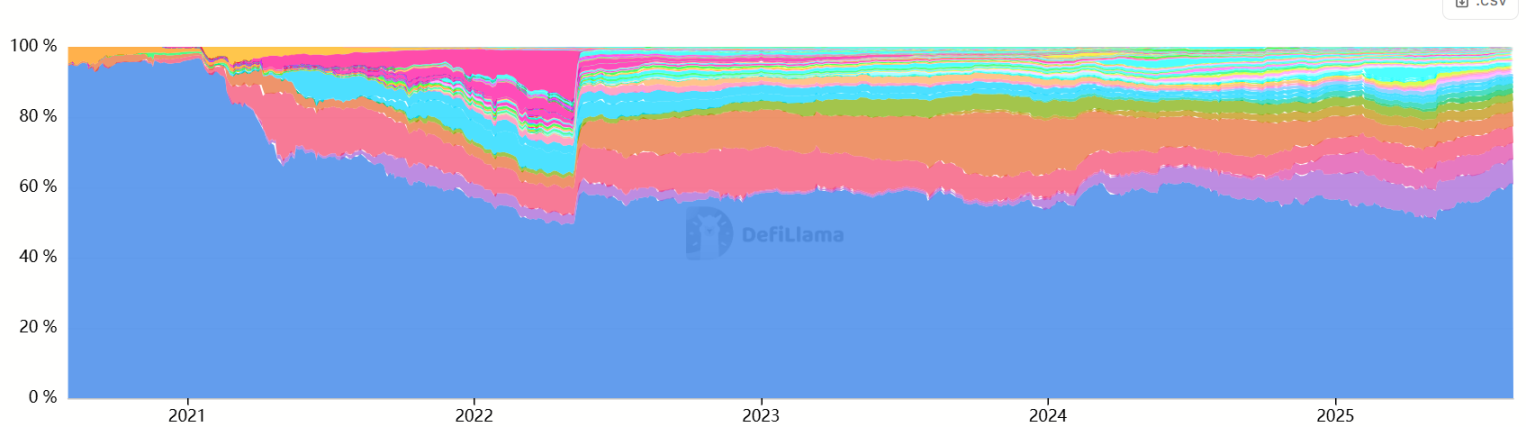

According to DefiLlama, Ethereum mainnet’s total DeFi value locked (TVL) has soared past $94.552 billion, exceeding Solana’s $10.828 billion and cementing Ethereum’s dominance in DeFi. This level of activity gives Ronin a vast pool of users and liquidity, ensuring that post-migration, in-game assets can circulate seamlessly across the Ethereum ecosystem for higher adoption.

Ethereum’s forward-looking technology roadmap also increases L2’s appeal. Following the Dencun upgrade in 2024, the Pectra (Prague-Electra) hard fork was deployed successfully in Q1 2025, significantly boosting scalability, slashing fees, and refining staking mechanics. Looking ahead, Ethereum will roll out the Fusaka upgrade by year-end—the first post-Pectra upgrade focused squarely on performance. Fusaka will implement multiple major Ethereum Improvement Proposals (EIPs), vastly expand blob capacity, and allow Layer-2 rollups (like Arbitrum and Optimism) to handle more data at lower cost, paving the way for transaction throughput in the tens of thousands TPS range.

Upgrades such as Verkle trees and PeerDAS will also lower node costs and hardware requirements, further promoting network decentralization—including support for mobile and light clients.

For Ronin, this means evolving from an isolated sidechain to a thriving, modular ecosystem, strengthening its long-term positioning in the Web3 gaming landscape.

Migration Set for Q2 2026, Token to Debut New “Proof of Allocation” Model

Ronin will complete its migration in Q2 2026, building on Polygon’s Chain Development Kit (CDK). The network will gain from Ethereum’s world-class security and decentralization, with transaction speeds projected to increase twelvefold.

This speed boost is critical for games like Axie Infinity, allowing for seamless NFT trading and in-game economic activity. Developers stand to benefit as well. Ronin is positioning itself as “Ethereum’s gaming engine,” attracting more third-party builders to launch custom L2 chains. New projects—including Cambria Duel Arena, Fableborne, and Angry Dynomites—are already taking root, using L2 DeFi integration to connect gaming and finance.

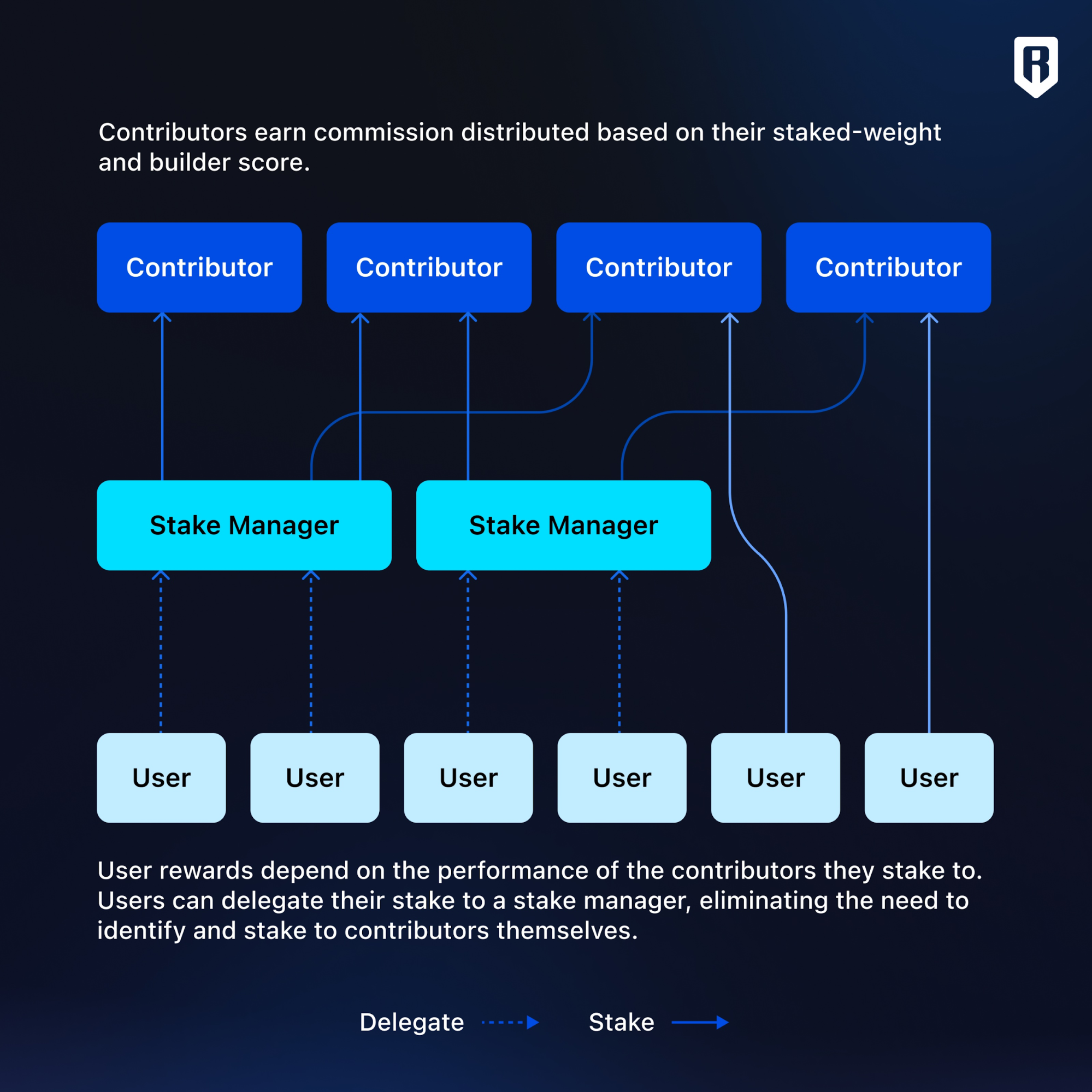

Importantly, after migration, RON token rewards will shift to a new “Proof of Allocation” model that directly incentivizes contributors and builders.

In recent years, RON rewards flowed to Governing Validators and Regular Validators to maintain network security. With this upgrade, rewards will go to Governing Validators and Contributors, strengthening alignment between builders and users and introducing a new cycle centered on the RON token.

Sky Mavis co-founder Jihoz once described Ronin as “the Nintendo of crypto.” As this migration unfolds, Ronin could well advance the future of blockchain gaming.

Disclaimer:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [1912212.eth, Foresight News]. For any questions regarding this reprint, contact the Gate Learn team; requests will be handled according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without properly referencing Gate.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

What is Neiro? All You Need to Know About NEIROETH in 2025

Our Across Thesis

An Introduction to ERC-20 Tokens