RWA Rediscovered: The On-Chain Rebirth of Traditional Assets

Reposting original article: “RWA Rediscovered—A New Life for Traditional Assets On-Chain”

Introduction

Since 2024, Real-World Assets (RWA) have again emerged as a central narrative in the crypto sector. From stablecoins to U.S. Treasuries and now to exploratory tokenized stocks and alternative assets, the on-chain migration of real-world assets is moving beyond a proof-of-concept phase into broad expansion. This momentum is powered not only by technological advancement, but also by increasing regulatory clarity and traditional finance’s proactive adoption of blockchain infrastructure. The current RWA surge is no coincidence—it's the intersection of multiple catalysts:

- Macroeconomic backdrop: Persistently high global interest rates are prompting institutional capital to re-evaluate on-chain yield solutions.

- Regulatory progression: The U.S., Europe, and other major jurisdictions are establishing frameworks for regulated tokenized assets, broadening the space for compliant projects.

- Technology advancement: Core infrastructure for on-chain settlement, KYC modules, institutional wallets, and permissions management is maturing rapidly.

- DeFi integration: RWA is no longer merely a “wrapper” for off-chain assets, but now a fundamental component of the on-chain financial system—with liquidity, composability, and programmability.

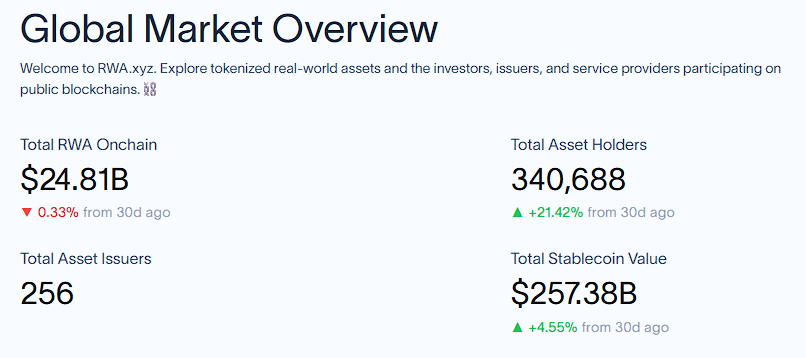

As of August 2025, total global RWA assets on-chain (excluding stablecoins) exceed $25 billion, with stablecoins reaching an aggregate $250 billion in market capitalization. RWA has become widely regarded as the key bridge bringing Web3 and traditional finance together, and the main vehicle for the mainstream adoption of on-chain finance.

1. Tokenization of Real-World Assets: Drivers and Implementation

1.1 Why RWA? Why bring real-world assets on-chain?

Traditional finance relies on centralized registries and multiple intermediaries, creating structural inefficiencies that restrict capital flows and financial inclusion:

- Liquidity constraints: Real estate, private equity, and long-term bonds typically involve high investment thresholds (often millions), long holding periods (years or decades), and limited transfer channels—locking up large pools of capital and impeding efficient allocation.

- Complex settlement and custody: Asset issuance, trading, and settlement all depend on layers of intermediaries—brokers, clearing houses, custodian banks—resulting in convoluted, time-consuming, and expensive processes (cross-border bond settlement may take 3–5 days), higher fees, greater operational risk, and more frequent delays.

- Lack of data transparency: Asset valuation is based on fragmented offline data (property appraisals, financial statements), with transaction records scattered across institutions. Real-time synchronization and cross-validation are difficult, leading to lagging prices and low portfolio management efficiency.

- Excessive participation barriers: Top-tier assets like private equity or fine art are mostly restricted to institutions or high-net-worth investors. Funding and compliance requirements largely exclude retail investors, exacerbating inequality in financial markets.

Blockchain’s decentralized ledger system restructures asset records and transaction logic by removing intermediaries—addressing the root pain points of traditional finance. The value proposition of tokenized real-world assets includes:

Blockchain’s Foundational Support

- Decentralized resilience: Asset ownership is recorded across the entire network, not at a single central entity, reducing risks of tampering or system failure and boosting overall system reliability.

- Immutability and auditability: Once confirmed, on-chain transactions are permanently recorded and timestamped for backward tracing—providing tamper-proof “digital proof” of ownership transfer, minimizing fraud and disputes.

Tangible Value Added by Tokenization

- Liquidity overhaul: Fractional ownership lets high-value assets divide into smaller tokens (e.g., a $10 million building split into 1,000 $10,000 tokens). With 24/7 decentralized markets and AMMs, investment minimums fall sharply and trading is far more flexible.

- Process automation and disintermediation: Smart contracts automate asset issuance, dividend distributions, and redemptions, displacing manual processes; oracles relay real-world data (property value, enterprise revenue), enabling fully automated execution for use cases like insurance—cutting operational costs dramatically.

- Compliance and audit upgrades: On-chain KYC/AML rules let systems verify investor eligibility automatically; all transactions are instantly on-chain, simplifying audits and regulatory checks and, according to recent studies, reducing compliance costs by 30–50%.

- Atomic settlement and risk elimination: Smart contracts ensure simultaneous settlement of asset and funds, eradicating traditional counterparty risk and reducing cycles from T+3 to near-instant finality.

- Global access and DeFi compatibility: Tokenized assets ignore borders, circulating seamlessly in blockchain networks and serving as collateral for lending, yield farming, and more—enabling "one asset, multiple reuses" and maximizing capital efficiency.

- Overall, RWA tokenization is a Pareto improvement for the finance sector—driven by technology, radically improving efficiency.

Proof-of-Concept: The Stablecoin Experience

Stablecoins, as the “gateway” for real-world assets to enter crypto, have fully proven blockchain’s feasibility for uniting off-chain value with on-chain systems:

- Prototype model: USDT, USDC, and others map fiat reserves 1:1 on-chain, creating the first scalable fiat-to-blockchain bridge and validating “real asset tokenization.”

- Market validation: By August 2025, stablecoins reached $256.8 billion in market cap, dominating the RWA sector and proving the scale potential for tokenizing off-chain assets.

- Takeaways: Stablecoins have demonstrated the safety, transparency, and efficiency of the “off-chain asset, on-chain token” model, establishing tech and compliance frameworks for more complex RWA (real estate, bonds, etc.).

With blockchain, real assets break free from the constraints of legacy finance—shifting from “static holding” to “dynamic flow,” from “exclusive to the elite” to “accessible to all.”

1.2 How to RWA? The Pathway and Operational Framework

RWA ultimately means using blockchain to turn real, valuable assets into programmable digital certificates, closing the loop between off-chain value and on-chain liquidity. The operational flow typically follows four critical steps:

a) Off-Chain Asset Due Diligence and Custody:

- Asset due diligence: Third-party professionals (lawyers, accountants, appraisers) verify legal status, ownership, and value. For real estate—deeds and rent contracts; for gold—LBMA storage certification and audits; for receivables—blockchain-anchored corporate confirmations.

·Models of Custody in Practice:

Centralized custody

a. Advantage: Robust compliance, ideal for financial assets (Treasuries, corporate bonds). Example: MakerDAO’s bonds are custodied at a bank, with periodic on-chain collateral status updates.

Risks: Potential for misappropriation. In 2024, a Singapore real estate project’s out-of-sync registry created ownerless NFT assets, highlighting centralized custody’s information lag.

Decentralized custody

How it works: DAO governance and smart contract automation—example, Goldfinch on-chains loan repayments and defaults with code, not humans.

Challenges: Lacks legal recourse, and coding bugs can cause asset loss. Some projects use zero-knowledge proofs for ownership verification, but mass adoption is not yet here.

Hybrid custody

Best of both: Trusted third parties hold off-chain assets, blockchain nodes confirm on-chain data. Case: Huamin Data’s RWA Alliance Chain—banks/trusts as custodial nodes, regulators as compliance nodes (30%), ports as logistics nodes.

Example: Toucan Protocol’s carbon credits are custodial with environmental NGOs, on-chain records ensure transparency of trades and burns.

b) Legal Structure Setup:

SPVs, trusts, and similar vehicles grant on-chain token holders legal rights or claims, while building legally enforceable bridges to the off-chain legal system (“token = legal claim”).

Legal structure varies by jurisdiction:

- U.S.: “SPV segregation + securities compliance” is core. Commonly, a Delaware LLC holds the real asset (e.g., Treasuries, equity), while token holders own indirect LLC equity. SEC compliance—if the token is equity or debt, it must follow Reg D (accredited investors) or Reg S (foreigners); for split returns, “tokenized note” models clarify rights and avoid “unregistered securities” risk.

- Europe: Via MiCA, with trusts or EU SPVs (e.g., Luxembourg SICAV) holding assets and issuing asset-referenced tokens (ART). The linkage is enforced both by smart contracts and legal documents. MiCA mandates disclosure of custody, right allocation, and regular regulatory audits, ensuring legal bond between on-chain tokens and off-chain claims across the EU.

c) Token Minting and Issuance:

Assets are tokenized (typically as ERC-20) for on-chain liquidity and composability.

- Full 1:1 mapping: Each token represents the entire underlying asset. Example: Paxos Gold (PAXG) links one token to one ounce of gold, redeemable at all times. Treasury tokens like $OUSG are mapped 1:1 to short-term ETFs, including both principal and yield.

- Partial right mapping: Tokens represent certain economic rights (income, dividends) without full ownership—for example, rental income tokens from real estate, or interest-only tokens for bonds. This model lets investors buy fractional exposure to high-value assets.

d) On-Chain Integration and Circulation:

Tokens are integrated into DeFi—collateralized lending, market making, re-staking, asset structuring—with permission and compliance managed by on-chain KYC systems.

On-chain KYC is central to compliant trading, built on “on-chain identity + dynamic permission management”:

- Core function: Smart contracts connect with identity/KYC providers (Civic, KYC-Chain). After document submission and approval, users get a “KYC certificate” (only the verification hash, not the actual data).

- Permission controls: Smart contracts restrict trading—e.g., only “accredited investors” (net worth >$1 million) can trade private credit tokens; U.S. Treasury tokens might only allow redemptions for non-U.S. investors during specific windows.

- Privacy: Zero-knowledge proofs enable the user to prove eligibility without revealing their identity, balancing compliance with privacy—e.g., the KYC proof just says “EU AML passed,” not real name or address.

These four interlocking steps transform traditional assets into programmable, efficient, composable on-chain assets, preserving their intrinsic value and unleashing blockchain-powered liquidity.

2. RWA Categories: Major Asset Classes and Rise of the U.S. Treasury Narrative

Off-chain assets (RWAs) are flooding onto blockchains at record speed—ranging from traditional finance’s bread-and-butter (bonds, equities) to new real-economy use cases. Virtually any asset with value or legal rights is being explored for blockchain-based tokenization.

2.1 The Seven Leading RWA Asset Classes

Currently, the RWA landscape includes stablecoins, tokenized Treasuries, tokenized global bonds, private credit, commodities, institutional alternative funds, and tokenized equities. As of August 2025, on-chain RWAs reached $25.22B, with stablecoins and Treasuries as the dominant categories—stablecoins at $256.82B and tokenized government bonds at $6.80B (source: RWA.xyz).

2.1.1 Stablecoins

- While not a classic “off-chain” asset, stablecoins’ pegs are typically backed by fiat or bonds and thus dominate the broader RWA category.

- Examples: USDT, USDC, FDUSD, PYUSD, EURC

- Tokenization drivers: composable payments, on-chain financial rails, fiat settlement alternatives

- Trends: National stablecoins (KRW, JPY, etc.) to serve local crypto markets and mitigate USD dependence; banks exploring tokenized bank deposits; CBDC pilots (e.g., Hong Kong’s e-HKD) underway to build tech and policy know-how.

2.1.2 U.S. Treasuries

- U.S. Treasuries are the most prominent on-chain asset, over 60% of market share, serving as low-risk yield benchmarks for DeFi.

- Examples: Ondo, Backed, OpenEden, Matrixdock, Swarm

- Drivers: introduction of risk-free rates as DeFi yields fall; infrastructure (token wrapping, KYC lists, bridges) maturing; legal wrappers (SPVs, tokenized notes, BVI funds) ensure transparency and compliance.

- Products: $OUSG (Ondo) tracks short-term Treasury ETFs, paying daily interest.

2.1.3 Global Bonds

- Non-U.S. government and corporate bonds are increasingly tokenized.

- Examples: Backed, Obligate, Swarm

- Drivers: broader international and currency coverage, non-USD stablecoins (EURC), global yield curve development

- Challenges: legal complexity and inconsistent KYC standards

2.1.4 Private Credit

- Brings SME lending, real estate and working capital financing on-chain.

- Examples: Maple, Centrifuge, Goldfinch, Credix, Clearpool

- Drivers: real, sustainable on-chain yields; greater transparency and composability

- Typical structure: SPV manages assets, DeFi provides liquidity, investors earn on-chain rates; Chainlink for data attestation.

- Main tensions: transparency vs. privacy, yield vs. credit quality

2.1.5. Commodities

- Tokenized physical assets: gold, carbon, energy, etc.

- Examples: Tether Gold (XAUT), Pax Gold (PAXG), Toucan, KlimaDAO

- Drivers: on-chain investor exposure, robust custody + on-chain trading

- Trends: green finance, carbon markets, sustainability use cases

2.1.6 Institutional Funds

- Private equity, hedge funds, ETF shares issued on-chain

- Examples: Securitize, ADDX, RedSwan, InvestX

- Drivers: greater liquidity, lower minimums, global expansion among accredited investors

- Limitations: high compliance barriers, Reg D/Reg S only

2.1.7 Stocks

- Synthetic tokenization of equities

- Examples: Backed (xStock), Securitize, Robinhood, Synthetix

- Drivers: on-chain trading strategies, cross-chain arbitrage, fractional shares

- Still at early stage; compliance models evolving

Bonds are the technical benchmark—highly standardized, with clear contracts and payment mechanisms for seamless on-chain mapping. Physical asset diversity and legal complexity make tokenization harder for those categories. Also, bond yields are predictable and the link between on-chain and off-chain returns is efficient—making them the ideal starting point for RWA digitization.

2.2 U.S. Treasury RWA: Industry Bedrock

U.S. Treasury tokens are the dominant “gateway asset” for on-chain markets because they fill critical market gaps on both supply and demand sides:

Supply side: Built-in safety, clear compliance

- Government bonds are considered default-free, the world’s most trusted asset

- Established, highly liquid ETF/note secondary markets

- Tokenization legal frameworks are unusually stable and transparent

Demand side: “Risk-free yield” after DeFi’s yield model collapse

- Since the 2021 liquidity peak, DeFi native yields have dried up

- Investors seek real, composable yield—Treasury tokens top the list

- Protocols like LayerZero, EigenLayer, and Pendle boost demand for “on-chain rate anchors”

Technical maturity: Standardized product structures

- Tokenized notes tied to ETF NAV, daily interest payments

- Real-time, composable stablecoins

- Audits, oracles, proof of reserve, and NAV tracking all in place

Regulation: Transparent, institution-ready

- Most protocols use Reg D/Reg S for accredited investors

- Tax and compliance risks relatively low

- Institutions can participate, bridging TradFi and DeFi

3. RWA: Progress and Market Structure

RWA is moving from story to substance—assets, technology, compliance, and players are evolving. Here, we map the current state by tracking asset trends, ecosystem growth, geographic regulation, and institutional engagement:

3.1 Market Progress and Key Trends

RWA is on a tear: by mid-2025, global on-chain RWA value topped $23.3 billion, up nearly 380% since early 2024, making it crypto’s second fastest-growing category. Wall Street, Tether, Visa, and BlackRock are all launching products. U.S. Treasury assets, with their stability, continue to lead; private credit is expanding for higher yields and risk diversification; commodity tokenization is broadening; and equity tokenization is working through regulatory hurdles.

Treasury Market (T-Bills): Main Growth Engine

- By August 2025, on-chain Treasury assets reached $68 billion, over 200% year-on-year growth—making it the largest RWA asset class after stablecoins.

- Platforms like Ondo, Superstate, Backed, Franklin Templeton have mapped ETFs and money market funds on-chain.

- Institutions see Treasuries as the core on-chain yield infrastructure; DeFi protocols use them to build “on-chain central banks.”

- Compliance, settlement, and legal structures are most advanced for these products.

Private Credit: High Yields, High Risks

- Protocols like Maple, Centrifuge, and Goldfinch are pioneering SME loans, revenue sharing, and consumer finance on-chain.

- Returns are high (8–18%) but tough to underwrite—reliant on off-chain diligence and custody. Some projects (TrueFi, Clearpool) are shifting toward institutional use.

- Goldfinch and Centrifuge piloted new lending in Africa and Asia in 2024, boosting inclusion.

Commodities: Gold & Energy Tokenization

- Projects like Paxos Gold (PAXG), Tether Gold (XAUT), Meld, and 1GCX use tokens to represent precious metals.

- Gold is the first choice, thanks to clear reserves and stable value—often a stablecoin backstop.

- Energy tokens (carbon credits, oil) face tighter regulation and remain experimental.

Equity Tokenization: Early Progress, but Regulatory Limits

- On-chain equity tokens total only $362 million (1.4% of segment), with Exodus Movement (EXOD) accounting for 83%.

- Platforms (Securitize, Plume, Backed, Swarm) are mapping U.S./European shares and startups onto tokens via compliance-first models.

- Biggest hurdles: secondary market compliance and KYC; some use permissioned chains and address whitelists to adapt.

Looking forward, RWA is poised for trillion-dollar growth. Citi predicts $4 trillion in tokenized private assets by 2030; BlackRock forecasts a $16 trillion RWA tokenization market (including private chains), or 1%–10% of global AUM. Upgrades in smart contracts, cross-chain tech, IoT feeds, AI models, and privacy tools (e.g., zero-knowledge proof) will further propel RWA use cases—from carbon and data to IP tokenization. If global regulatory frameworks converge, RWA will drive seamless, global asset flows—reshaping global portfolios.

3.2 Ecosystem and Participant Landscape

3.2.1 On-Chain Protocol Distribution

| Chain | Notable Projects | Features |

|---|---|---|

| Ethereum | Ondo, Superstate, Franklin, Plume | Leading institutions, robust compliance, mature stablecoin and fund ecosystem |

| Stellar | Franklin Templeton FOBXX | Institutional-grade custody transparency, efficient payments/issuance |

| Solana | Maple, Zeebu, Clearpool | Low fees for high-frequency credit, but infra/security still evolving |

| Polygon | Centrifuge, Goldfinch | Off-chain mapping & DAO credit governance, low cost and scalable |

| Avalanche/Cosmos | Backed, WisdomTree | Exploring multichain compliance/fund governance, experimental |

Trend: Ethereum remains the core for compliant RWA (funds, bonds); credit RWAs are beginning to shift to low-fee, high-throughput chains.

| Region | Regulation | Policies | Key Impact |

|---|---|---|---|

| U.S. | Strict, diverse | SEC/CFTC review, Reg D/S/CF | Institutions favor Reg D (Securitize, BlackRock) |

| EU | Open, harmonized | MiCA (2024) | Clear separation of e-money/asset tokens, easier compliance |

| Singapore | Very friendly | MAS sandbox, RMO license | Supports RWA pilots/multicurrency; Circle, Zoniqx live |

| Hong Kong | Gradually opening | SFC VASP, crypto ETF policy | Supports compliant tokenized funds, TradFi–Web3 integration |

| Dubai (VARA) | Most proactive | Layered licensing, sandboxes | Middle East RWA hub; Plume, Matrixdock involved |

Singapore, Hong Kong, and Dubai are regulatory leaders—becoming regional magnets for capital and projects.

3.2.3 Institutional Participation

Institutions are moving from pilot to deployment. Top players include:

| Type | Institution | Strategy |

|---|---|---|

| Asset Managers | BlackRock, Franklin Templeton, WisdomTree | On-chain funds/MMFs on Ethereum/Stellar |

| Broker/Issuer | Securitize, Tokeny, Zoniqx | Compliant stock/bond/fund launches, legacy-on-chain integration |

| Crypto Protocols | Ondo, Maple, Goldfinch, Centrifuge | Native RWA structures for DAOs, treasuries, DeFi |

| Trading/Derivatives | Backed, Swarm, Superstate | Tokenized asset liquidity, LP compositions, compliant trading |

Institutions are diversifying—acting as issuers, settlement agents, custodians, and liquidity providers. RWA is the bridge directly linking Web3 and traditional finance.

4. Notable Project Case Studies

Below, we profile leading RWA projects in Treasuries, private credit, commodities, and equities, breaking down token models, investor profiles, product structure, and yield logic:

4.1 Treasuries: Ondo Finance

Ondo Finance specializes in tokenizing traditional assets—especially U.S. Treasuries—offering low-risk, composable returns to crypto investors and mediating between traditional and decentralized finance through compliant product structures.

• Token model: ERC-20 tokens pegged 1:1 to underlying Treasury ETFs (e.g., $OUSG), with daily interest payments.

• Investor profile: Institutions (family offices, asset managers) and accredited investors (Reg D/S), with some indirect DeFi retail participation.

• Product structure: “On-chain fund” structure—SPV holds Treasuries, smart contracts automate subscriptions/redemptions/interest, enabling use as DeFi collateral (Aave, Compound, etc.).

• Yield logic:

• Base returns: Treasury interest, after 0.15%–0.3% management fees, distributed pro-rata.

• DeFi synergy: $OUSG can be used as DeFi collateral for additional yield—borrow, farm, or earn trading fees in liquidity pools.

4.2 Private Credit: Maple Finance

Maple Finance is a multi-chain DeFi platform providing institutional lending and RWA investment on Ethereum, Solana, and Base. Clients include hedge funds, DAOs, crypto trading firms. Core offerings: low-collateral loans, tokenized Treasuries, and trade receivable pools. AUM reached $2.4B as of June 2025.

-

Token model: SYRUP (ERC-20, 118M supply, 111M in circulation).

-

Staking: Stakers backstop loan defaults with SYRUP, receiving platform fees and rewards; 20% of every 0.5%–2% loan fee buys back SYRUP for stakers.

- Investor base: Institutional capital (hedge funds, VCs), DeFi treasuries (e.g., Alameda), with all borrowers subject to off-chain KYC and credit checks.

- Product structure: Decentralized credit pools—smart contracts match loan supply/demand and automate repayments/defaults, leveraging Chainlink for data attestation.

-

Yield logic: Lenders earn interest, rates tracks riskiness; stakers share platform revenue and backstop defaults; institutional borrowers access fast funding—driving the “lend–borrow–reward” loop.

4.3 Commodities: Paxos Gold ($PAXG)

Paxos Gold, issued by regulated fintech Paxos, tokenizes LBMA-certified gold, combining store-of-value with blockchain programmability. Investors avoid gold’s physical burdens and can trade globally 24/7 or use it as DeFi collateral.

-

Token model: $PAXG (ERC-20)—each token equals 1 ounce of gold, LBMA certified, held by top-tier custodians.

- Mint/redeem: Buy $PAXG, Paxos purchases matching gold; redeem, tokens burned and gold released—no excess issuance.

- Investor base: Retail (exchanges/wallets), institutions (hedging), DeFi protocols (collateral for stablecoins).

- Structure: Smart contracts link to chainproof of custody (via Chainlink PoR); users can redeem gold (with minimums/fees) or trade on DEX (Uniswap).

- Yield: Gold appreciation (inflation hedge) plus liquidity yield (stake $PAXG for $DAI, then farm). Paxos charges redemption/custody/trading fees to cover ops costs.

4.4 Equities: xStocks (Backed Finance)

xStocks, by Backed Finance, tokenizes U.S. equities like Tesla on Solana, offering 24/7 trading and DeFi integration. By July 2025, these tokens trade on Bybit, Kraken, Raydium, etc.

-

Token model: Solana SPL tokens (e.g., $TSLAx), 1:1 pegged to stocks held in custody by Backed and partners.

- Pricing: Chainlink oracles sync prices; during market closure (weekends), last close is used and on-chain supply/demand forms prices (prediction market).

- Investors: No strict accreditation (exchange KYC required); available to retail and small asset managers.

-

Structure: Backed pre-buys stocks, holds them with regulated brokers/banks, and mints tokens 1:1; redemptions burn tokens and release stocks; periodic PoR for transparency.

- Rights: No shareholder vote, but dividends distributed as token airdrops after payout.

- Circulation: 24/7 DEX/CEX trading, cross-chain plans in the works.

- Yield: Stock appreciation + dividends + liquidity premium from always-on, fractionalized trading. Backed earns fees for issuing, custody, and trading.

4.5 Infrastructure: Plume Network

Plume Network is a full-stack blockchain platform devoted to RWA—bridging traditional and crypto markets, and removing compliance, liquidity, and UX barriers.

-

Token model: $PLUME (ERC-20), 10B supply, 59% for community incentives; used for fees, governance, staking, payments.

- Incentives: Yield on RWA assets (10%–20% APR) plus $PLUME rewards for asset holding/staking—encourages ecosystem engagement.

- Investor base: Institutional (Brevan Howard, Haun Ventures), plus retail and crypto-native users via Passport wallet seeking “traditional + DeFi” returns and compliance.

-

Structure: Diverse assets (collectibles, alternatives, financial instruments); Arc for flexible token/NFT/RWA issuance, Nexus for oracles, Passport wallet, SkyLink cross-chain bridge, full compliance via partner licensing and ERC 3643/ONCHAINID standard for eligible token holding.

-

Yield: Investors—returns from assets, staking, trading; platform—issuance, transaction, and institution service fees, plus token value appreciation as ecosystem grows.

5. Challenges and Considerations

RWA’s dramatic rise isn't frictionless: it’s a collision of traditional asset logic and blockchain decentralization. Five key structural challenges:

5.1 Legal and Regulatory: Striking a Moving Balance

- Regulatory arbitrage: Most projects use "offshore registration + domestic operation" (BVI, etc.)—ostensibly Reg D/S compliant, but creating legal gray zones. Disputes across EU/US lines expose investors to jurisdictional gaps and recourse risks.

- Ownership uncertainty: SPVs claim “tokens = legal rights,” but global law has yet to support direct linkage between on-chain token transfers and off-chain ownership. What if a token-holder faces a lawsuit—can a court freeze the corresponding property? No precedent so far; the legal bridge remains unproven.

5.2 Valuation and Transparency: Data Trust Boundaries

- Oracle manipulation: Decentralized oracles still depend on centralized data (S&P, JLL, etc.). Collusion between protocols and agencies could create systemic fraud—smart contracts would enforce fake data blindly.

- Pricing lag: Standard assets can be updated in real time, but private assets revalue slowly and token prices can drift from reality—enabling arbitrage and liquidation risk.

5.3 Liquidity and Composability: Synergy Boundaries

- Liquidity stratification: Standardized assets (Treasuries, gold) have deep DEX/CEX pools; non-standard assets (private credit, equity) are often illiquid and rely on internal redemption—falling short of blockchain’s liquidity promise.

- Cross-chain composability: Bridges and Layer2s aim to enable multi-chain flows, but custody, fees, and security risks remain barriers—sometimes offsetting composability benefits completely.

5.4 Risk Management: Connecting On- and Off-Chain Risk

- On-chain rules can’t cover off-chain events: Smart contracts can handle on-chain risk (collateral, liquidation) but not real-world defaults or disasters; the “oversight gap” means investors can still face loss.

- Systemic risk: RWA is closely tied to traditional markets, and DeFi leverage can amplify moves—sharp swings may trigger on-chain liquidity crises.

5.5 Technical Infrastructure and Trust: Moving Toward Decentralization

- Blockchain throughput lags institutional RWA needs—Ethereum’s speed/costs limit big players, and Layer2s haven’t fully earned institutional trust yet.

- Hybrid trust: RWA still relies on custodians and auditors (for gold, bonds, etc.)—so the model is “decentralized tech, centralized trust.” Whether this really “blockchain-empowers” traditional finance or just upgrades it, remains to be seen.

RWA is a grand experiment in cross-system integration. The hurdles are both technical and philosophical. Their solutions will require the combined efforts of industry, regulators, and developers—market discovery will ultimately shape the outcome.

Disclaimer:

- This article is republished from TechFlow, original title “RWA Rediscovered—A New Life for Traditional Assets On-Chain.” Copyright belongs to the original authors [kleinlabs X Aquarius]. For republication concerns, contact the Gate Learn Team for prompt handling.

- Disclaimer: The views and opinions expressed are those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn Team. Unless Gate is named, do not copy, distribute, or plagiarize these translations.

Related Articles

Reshaping Web3 Community Reward Models with RWA Yields

ONDO, a Project Favored by BlackRock

Real World Assets - All assets will move on-chain

What Are Crypto Narratives? Top Narratives for 2025 (UPDATED)

Gate Research: Understanding the Core Logic and Hot Projects of RWA in One Article