Bitcoin Price Prediction: Bitcoin Price Hits All-Time High as Institutional Investors Continue to Accumulate

Bitcoin Price Hits All-Time High

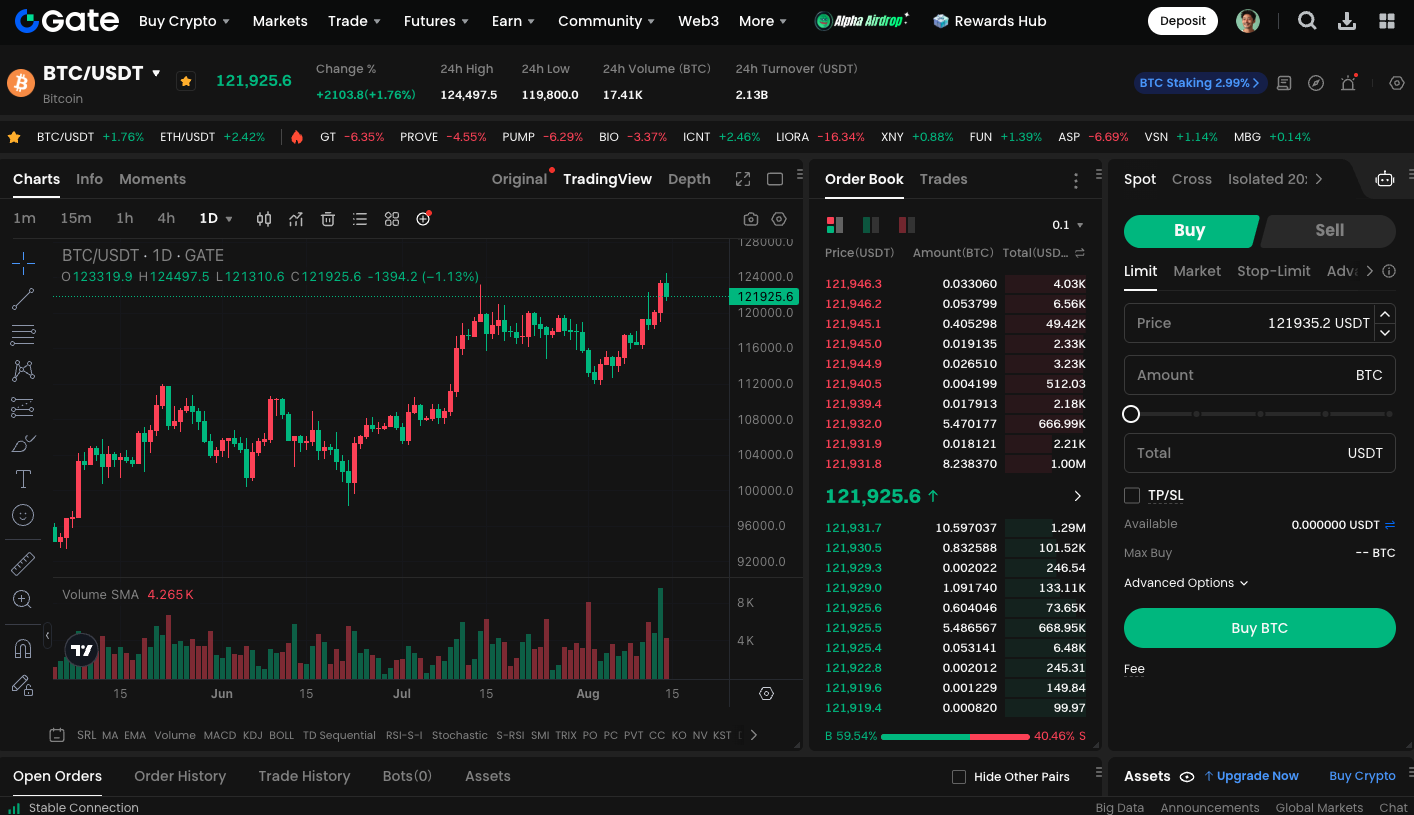

Bitcoin reached a new all-time high during Thursday’s morning session in Asia, peaking at approximately $124,400 and surpassing the high seen in July. Year-to-date in 2025, Bitcoin has surged over 60% from its low, reflecting sustained optimism in the market.

This rally is driven by two key factors. First, expectations for a Federal Reserve rate cut in September have rapidly intensified. Second, institutional capital and ETF inflows remain robust. The market widely believes that the latest U.S. CPI year-over-year increase of 2.7%, which came in below expectations, could prompt the Fed to pivot toward a more accommodative stance. In addition, the Treasury Secretary’s public call for multiple rate cuts in succession has further fueled investors’ risk appetite.

Institutions and ETFs Continue Accumulating

Recent data shows that U.S. spot Bitcoin ETFs recorded a single-day net inflow of $86.91 million on August 13, bringing total inflows to $54.76 billion. The total assets under management for U.S. spot Bitcoin ETFs have reached $156.69 billion, representing about 6.48% of Bitcoin’s total market capitalization. Among these, BlackRock’s iShares Bitcoin Trust leads with $89.11 billion in assets, while Fidelity’s FBTC holds $24.77 billion.

Globally, all types of institutions and corporations now hold 3.65 million BTC, over 17% of the entire circulating supply. Beyond ETFs, public and private companies, governments, and DeFi contracts are also steadily increasing their holdings, which has tightened market liquidity.

Policy Support

In recent developments, President Trump has signed multiple executive orders encouraging the inclusion of crypto assets in 401(k) retirement plans, nominated crypto-friendly economists to the Federal Reserve Board, and issued orders prohibiting the denial of banking services to legal crypto businesses, thus fostering a more supportive regulatory landscape for the industry. The SEC also confirmed that certain liquid staking models do not qualify as securities, easing compliance pressures for ecosystems like Ethereum.

For spot BTC trading, visit: https://www.gate.com/trade/BTC_USDT

Summary

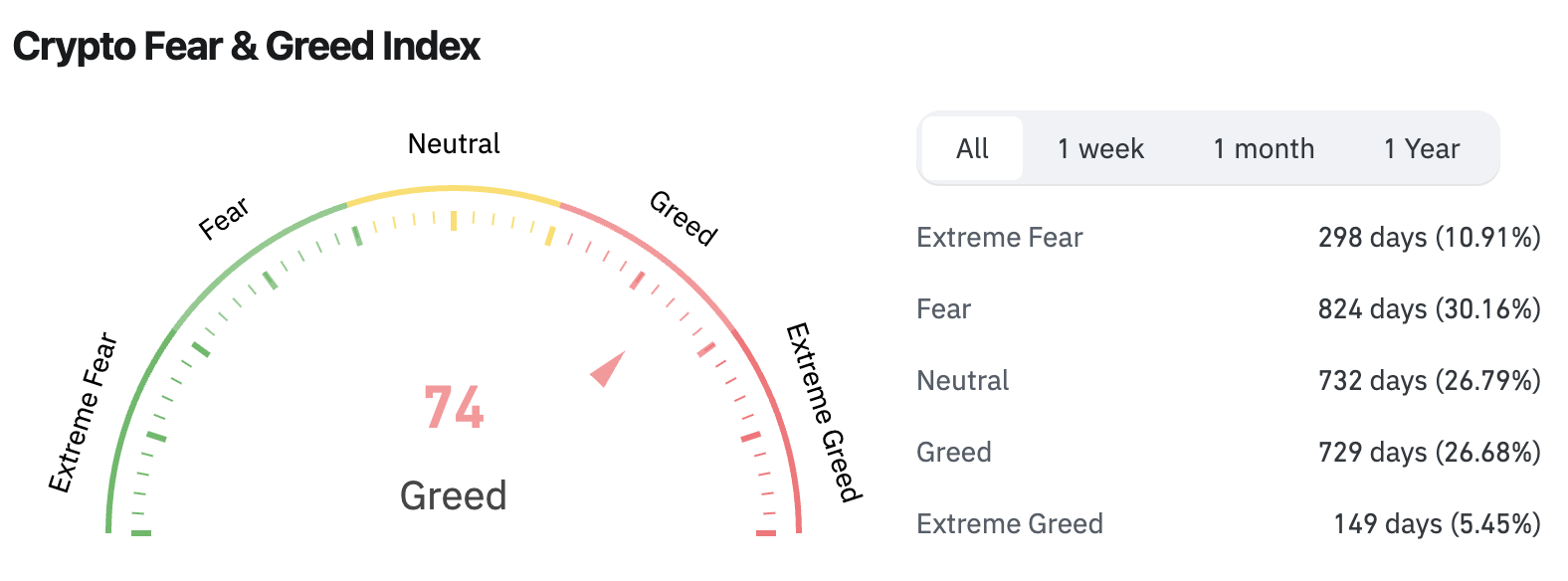

As of the latest update, the Fear and Greed Index is at roughly 74, placing the market firmly in the “greed” zone—a sign of strong investor confidence in the outlook. In the near term, Bitcoin may consolidate between $120,000 and $125,000, but with constrained supply and significant institutional holdings, there remains an opportunity to challenge even higher price levels before year-end.

(Source: coinglass)

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025