Việc ra mắt các stablecoin được hỗ trợ bởi nhân dân tệ của Trung Quốc cho một đối tượng rộng rãi có thể dẫn đến việc hợp pháp hóa Bitcoin và kích thích nhu cầu mới cho sự giàu có ròng của các hộ gia đình Trung Quốc ($85 triệu, khoảng một nửa so với Hoa Kỳ. ) có thể thúc đẩy việc chấp nhận thêm đáng kể.

Xem bản gốcAxelAdlerJr

Chưa có nội dung

AxelAdlerJr

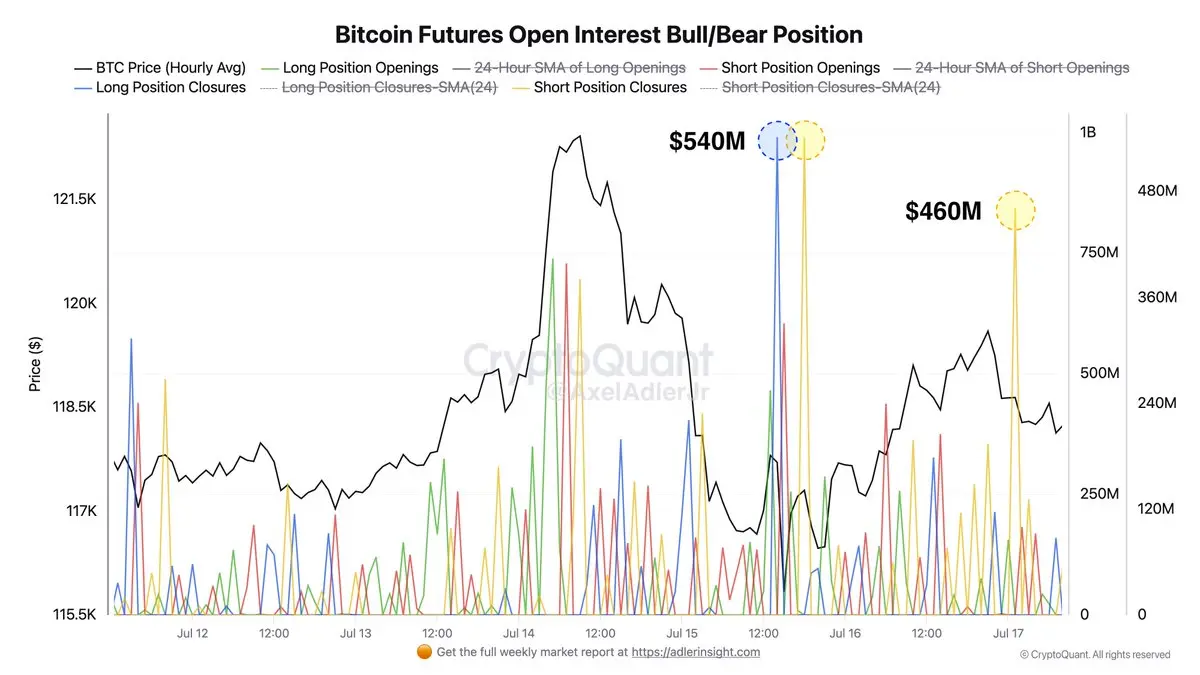

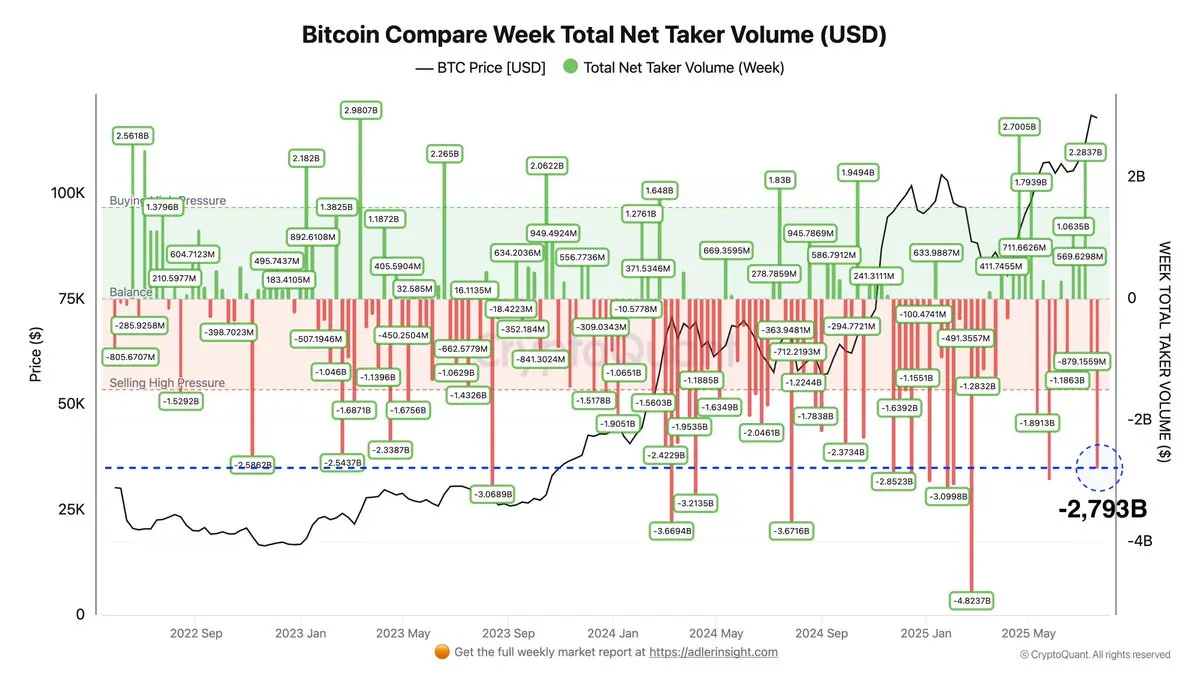

Tuần này sắp kết thúc và trong chu kỳ bull này, chỉ có 12 tuần cho thấy áp lực bán từ gấu tương đương hoặc lớn hơn, chiếm khoảng 7,3% của toàn bộ chu kỳ.

Do đó, tuần này nằm trong 7% mức độ cực đoan nhất về khối lượng bán, tuy nhiên giá đã phục hồi lên $117K, điều này có thể được coi là một tín hiệu tích cực.

Xem bản gốcDo đó, tuần này nằm trong 7% mức độ cực đoan nhất về khối lượng bán, tuy nhiên giá đã phục hồi lên $117K, điều này có thể được coi là một tín hiệu tích cực.

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

ECB đã giữ lãi suất chính ở mức 2.00%, phù hợp với kỳ vọng của thị trường. Lạm phát đang ở mức mục tiêu trung hạn 2%, áp lực giá cả đang giảm và tăng trưởng lương đã chậm lại. Trong buổi họp báo, Chủ tịch Christine Lagarde đã mô tả lập trường là chờ và quan sát và cho biết ECB sẽ theo dõi sự phát triển rủi ro trong những tháng tới.

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

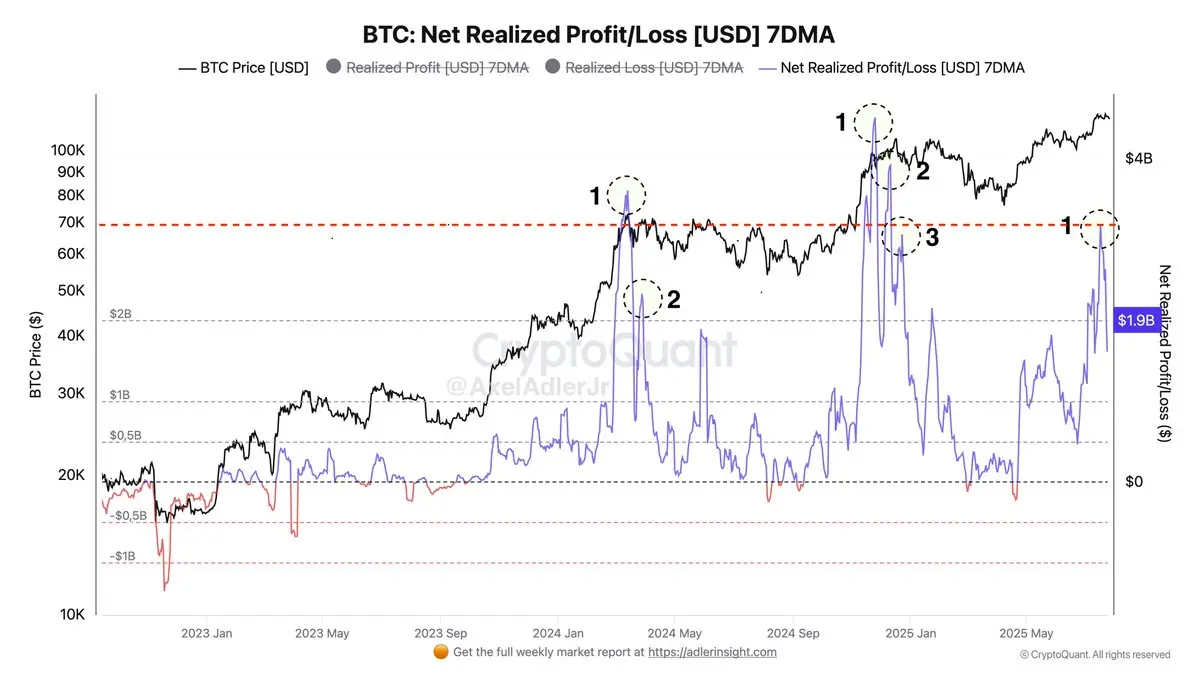

Biểu đồ lợi nhuận/lỗ thực tế ròng rõ ràng cho thấy sự tăng vọt mạnh mẽ của việc chốt lời bởi các nhà đầu tư trong các giai đoạn tăng giá. Có khả năng cao chúng ta sẽ thấy một hoặc hai làn sóng chốt lời nữa trước khi giá bước vào một đợt điều chỉnh sâu hơn.

Mỗi sóng như vậy sẽ đi kèm với sự điều chỉnh và tích lũy ngắn hạn, nhưng miễn là các đỉnh lợi nhuận thực hiện ròng không vượt quá các cực đại trước đó hoặc có khối lượng tương đương, xu hướng tăng vẫn giữ nguyên.

Lý tưởng là, những đợt điều chỉnh lành mạnh này sẽ cho phép thị trường hạ nhiệt khỏi sự quá nóng và tiếp tục di chuyển lên.

Xem bản gốcMỗi sóng như vậy sẽ đi kèm với sự điều chỉnh và tích lũy ngắn hạn, nhưng miễn là các đỉnh lợi nhuận thực hiện ròng không vượt quá các cực đại trước đó hoặc có khối lượng tương đương, xu hướng tăng vẫn giữ nguyên.

Lý tưởng là, những đợt điều chỉnh lành mạnh này sẽ cho phép thị trường hạ nhiệt khỏi sự quá nóng và tiếp tục di chuyển lên.

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

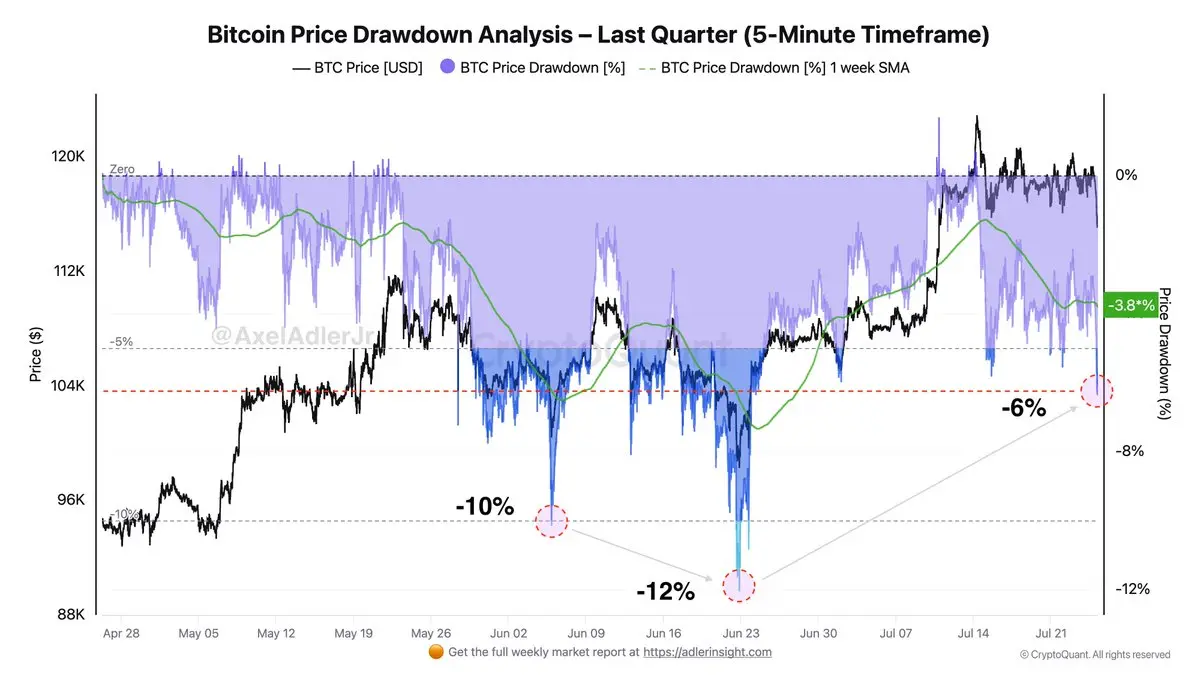

Biểu đồ cho thấy trong quý vừa qua, mức giá tối đa 'Thả' trong khung thời gian 5 phút đã đạt -10% vào đầu tháng Sáu và -12% vào giữa tháng, trong khi mức giảm trung bình hàng tuần (đường xanh) giữ ở mức 3.8%. Sự giảm giá hiện tại -6% nằm trong khoảng dao động bình thường, chỉ sâu hơn 2.2% so với mức trung bình và còn xa so với các mức cực đoan.

Mặc dù hiệu ứng hình ảnh không dễ chịu, nhưng sự giảm giá hiện tại nằm trong chu kỳ hợp nhất tiêu chuẩn.

Mặc dù hiệu ứng hình ảnh không dễ chịu, nhưng sự giảm giá hiện tại nằm trong chu kỳ hợp nhất tiêu chuẩn.

EARLY-5.37%

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

Các thị trường cổ phiếu châu Á đang giảm khi các nhà đầu tư đánh giá những tác động của thỏa thuận thương mại mới ký giữa Hoa Kỳ và Nhật Bản và chờ đợi tiến triển trong các cuộc đàm phán lớn khác.

Các quan chức Mỹ và Trung Quốc dự kiến sẽ gặp nhau ở Stockholm vào tuần tới, với Trung Quốc đối mặt với hạn chót vào ngày 12 tháng 8 để đạt được thỏa thuận hoặc đối mặt với thuế quan cao hơn từ Mỹ.

Các quan chức Mỹ và Trung Quốc dự kiến sẽ gặp nhau ở Stockholm vào tuần tới, với Trung Quốc đối mặt với hạn chót vào ngày 12 tháng 8 để đạt được thỏa thuận hoặc đối mặt với thuế quan cao hơn từ Mỹ.

MAJOR0.7%

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

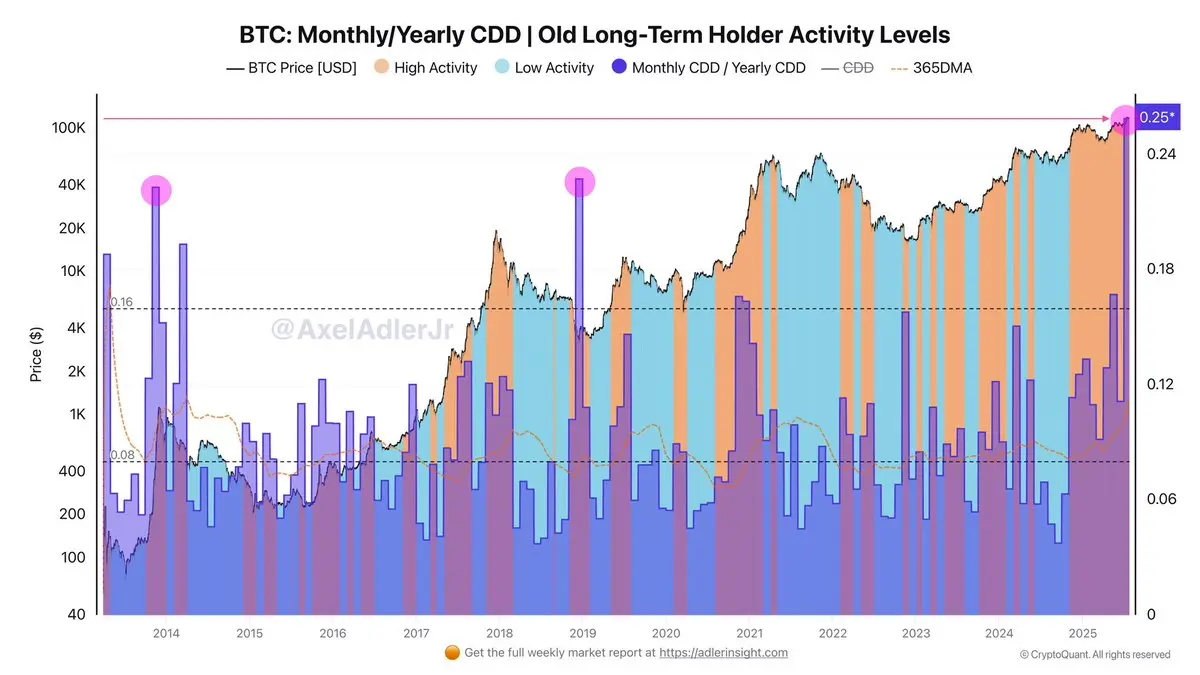

Một tỷ lệ CDD hàng tháng / CDD hàng năm bất thường cao là 0,25 đang được quan sát thấy trên thị trường với giá trong khoảng $106 K–$118 K, điều này so sánh được với các đỉnh lịch sử của năm 2014 và sự điều chỉnh của năm 2019.

Điều này có nghĩa là những người nắm giữ lâu dài (LTH), những người đã giữ đồng xu của họ trong nhiều năm, đang đồng loạt chuyển chúng ra thị trường. Những đỉnh CDD như vậy báo hiệu sự phân phối tích cực bởi những người chơi dày dạn kinh nghiệm.

Cùng lúc đó, nhu cầu kho bạc và dòng vốn vào BTC-ETF vẫn ở mức cao, vì vậy việc phân phối này khó có thể ngăn chặn đà tăng, mà c

Xem bản gốcĐiều này có nghĩa là những người nắm giữ lâu dài (LTH), những người đã giữ đồng xu của họ trong nhiều năm, đang đồng loạt chuyển chúng ra thị trường. Những đỉnh CDD như vậy báo hiệu sự phân phối tích cực bởi những người chơi dày dạn kinh nghiệm.

Cùng lúc đó, nhu cầu kho bạc và dòng vốn vào BTC-ETF vẫn ở mức cao, vì vậy việc phân phối này khó có thể ngăn chặn đà tăng, mà c

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

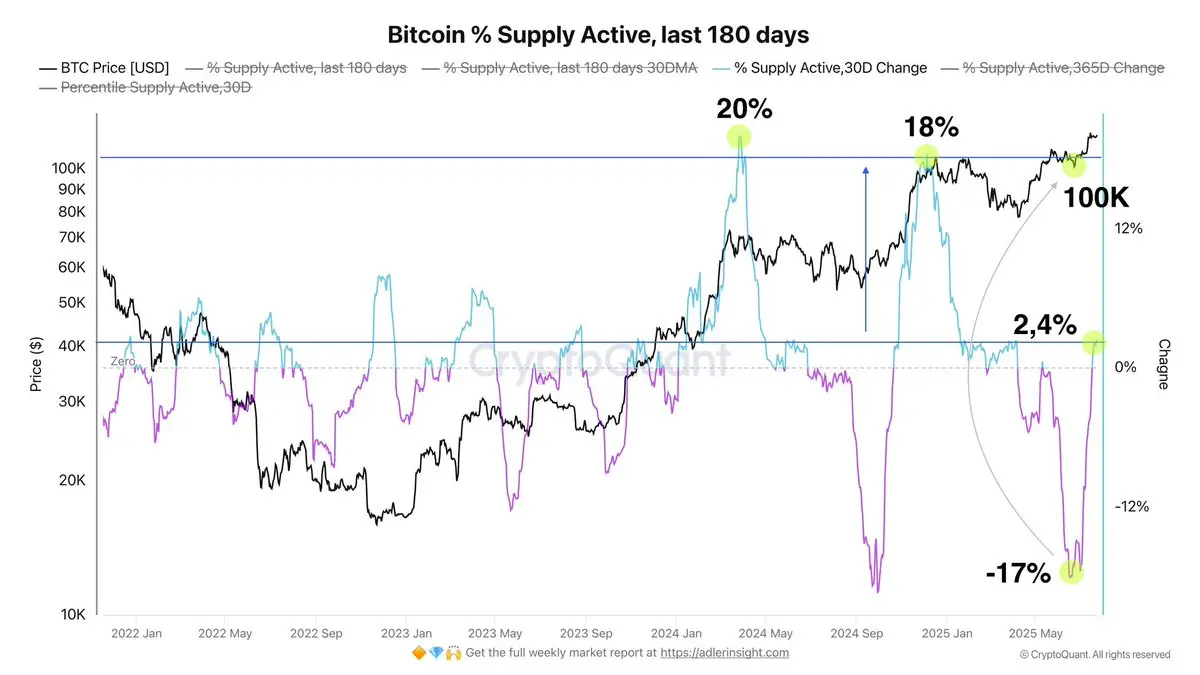

Tỷ lệ coin hoạt động trong 180 ngày qua (% Cung Cấp Hoạt động) đã tăng mạnh gấp đôi trong các chu kỳ vĩ mô trước đó: đầu tiên lên 20 % khi BTC tăng lên $70,000 vào mùa xuân 2024, và sau đó vào tháng 12 năm 2024 lên 18 % khi lần đầu tiên vượt qua mức tâm lý $100,000. Điều này phản ánh sự di chuyển của các coin đang ngủ ra khỏi kho lưu trữ và phân phối lại ra thị trường.

Vào tháng 6 năm 2025, tại mức $100,000, hoạt động cung bắt đầu tăng lên và cho đến nay đã tăng từ vùng tiêu cực lên +2.4% trong 30 ngày. Sự gia tăng này cho thấy rằng những người nắm giữ đã bắt đầu phân phối; độ trễ của sự thay

Xem bản gốcVào tháng 6 năm 2025, tại mức $100,000, hoạt động cung bắt đầu tăng lên và cho đến nay đã tăng từ vùng tiêu cực lên +2.4% trong 30 ngày. Sự gia tăng này cho thấy rằng những người nắm giữ đã bắt đầu phân phối; độ trễ của sự thay

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

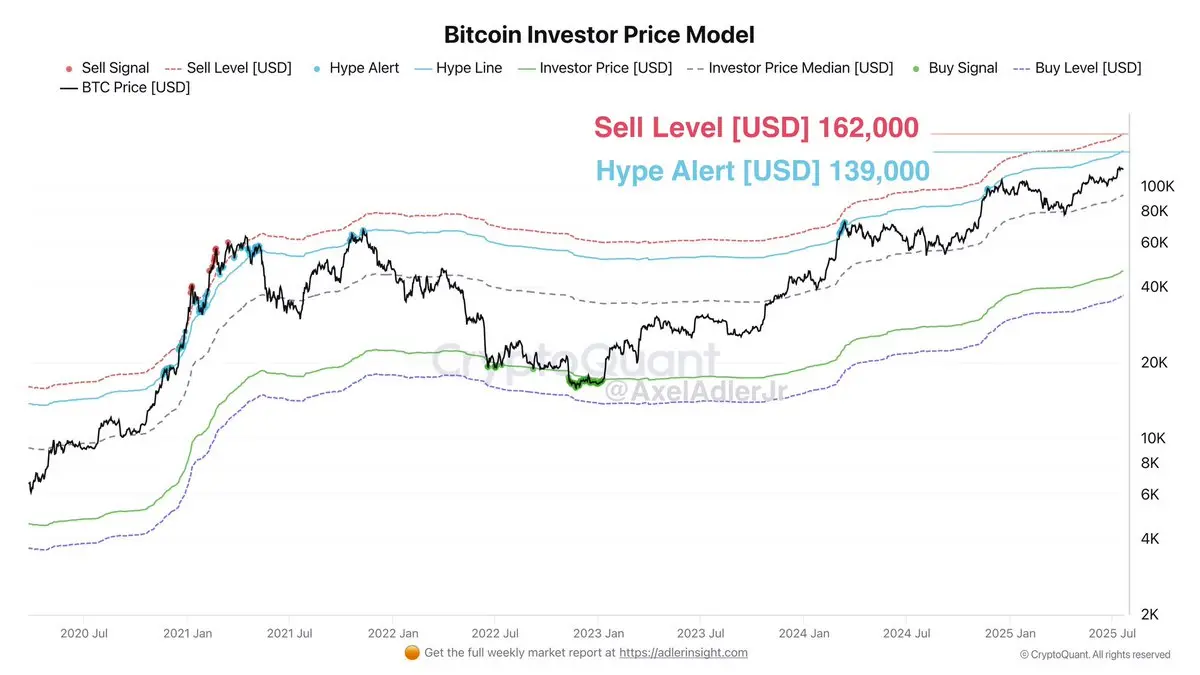

Tính đến giá hôm nay là $117 K, Bitcoin đang ở vùng tăng trưởng giữa Giá Trung Bình của Nhà đầu tư ($92 K) và mức Cảnh báo Hype ($139 K).

Điều này cho thấy rằng hoạt động mua vẫn được hỗ trợ bởi các tham gia thị trường: họ sẵn sàng giữ hoặc thêm vào vị thế của mình miễn là giá vẫn nằm trên vùng thoải mái của họ.

Đồng thời, chúng ta vẫn chưa bước vào giai đoạn lạc quan quá mức, vẫn còn chỗ cho sự gia tăng hơn nữa về phía $139 K mà không có nguy cơ quá nóng nghiêm trọng.

Xem bản gốcĐiều này cho thấy rằng hoạt động mua vẫn được hỗ trợ bởi các tham gia thị trường: họ sẵn sàng giữ hoặc thêm vào vị thế của mình miễn là giá vẫn nằm trên vùng thoải mái của họ.

Đồng thời, chúng ta vẫn chưa bước vào giai đoạn lạc quan quá mức, vẫn còn chỗ cho sự gia tăng hơn nữa về phía $139 K mà không có nguy cơ quá nóng nghiêm trọng.

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

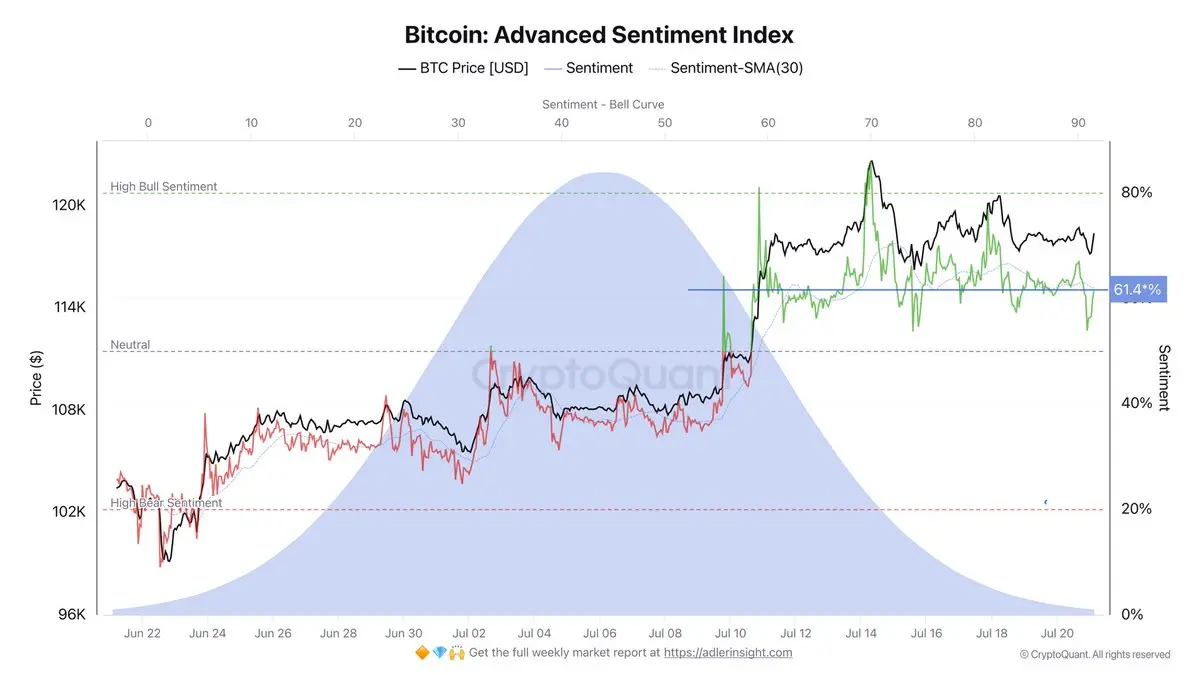

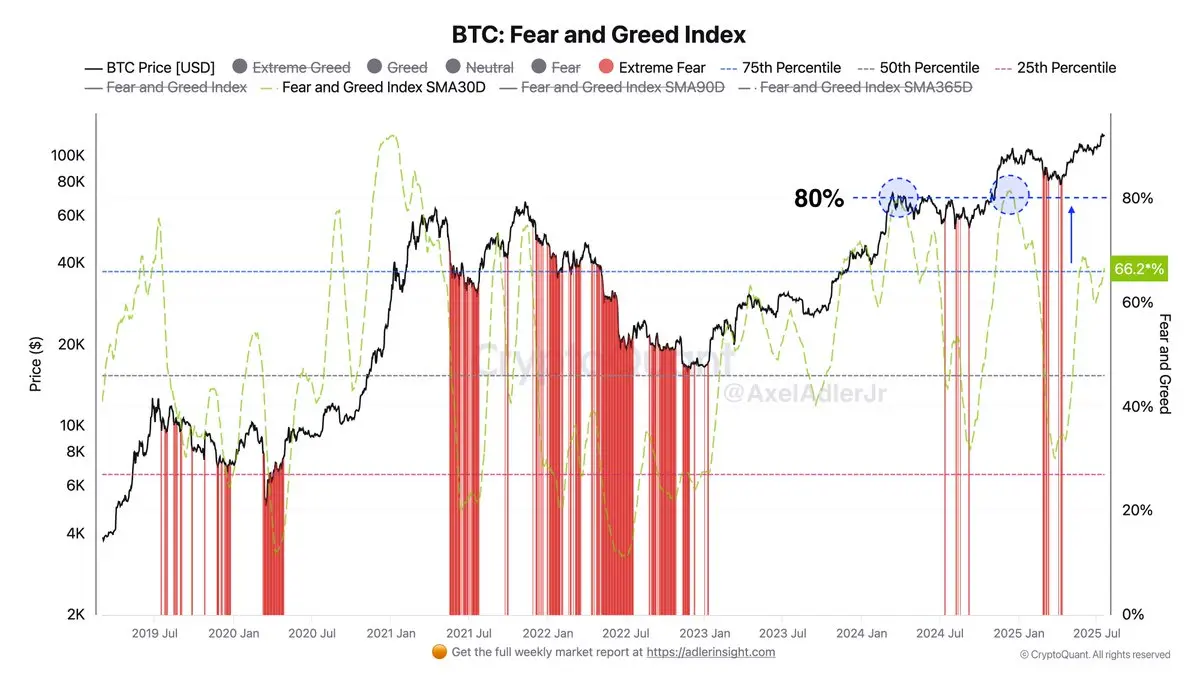

Thị trường đang bị chi phối bởi tâm lý tăng giá, nhưng những con bò không có sự hung hãn.

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

Đường trung bình động 30 ngày của Chỉ số Sợ hãi và Tham lam đã trở lại vùng lạc quan, hiện đang ở mức 66%. Tâm lý thị trường vẫn chủ yếu là tham lam, nhưng chúng ta vẫn chưa đạt đến ngưỡng cực đoan 75–80% trùng với các đỉnh cục bộ vào tháng 3 và tháng 12 năm 2024. Những con bò vẫn còn chỗ để đẩy giá lên cao hơn.

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

Hạ viện đã thông qua Đạo luật Rõ ràng về Thị trường Tài sản Kỹ thuật số (H.R. 3633) và Đạo luật Chống Nhà nước Giám sát CBDC (H.R. 1919) vào ngày 17 tháng 7, cả hai hiện đang chờ xem xét của Thượng viện.

Đạo luật GENIUS (S. 1582) đã được thông qua bởi cả hai viện và đang trên bàn của Tổng thống để ký.

Nguồn:

Xem bản gốcĐạo luật GENIUS (S. 1582) đã được thông qua bởi cả hai viện và đang trên bàn của Tổng thống để ký.

Nguồn:

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

🎉Cột mốc lớn cho Bitcoin.

Giá trị thực hiện của mạng lưới đã vượt qua 1 nghìn tỷ đô la lần đầu tiên, đạt mức cao nhất từ trước đến nay.

Khác với vốn hóa thị trường đơn giản, Realised Cap tổng hợp giá trị của mỗi coin tại thời điểm giao dịch cuối cùng của nó, cung cấp một cái nhìn thực tế hơn về vốn bị khóa trong mạng lưới.

Để so sánh: nếu một công ty kiếm được 1 đô la mỗi giây, thì sẽ mất 31 710 năm để tích lũy một triệu triệu đô la.

Bạn nghĩ điều này có ý nghĩa gì cho chu kỳ tăng trưởng tiếp theo của Bitcoin?

Xem bản gốcGiá trị thực hiện của mạng lưới đã vượt qua 1 nghìn tỷ đô la lần đầu tiên, đạt mức cao nhất từ trước đến nay.

Khác với vốn hóa thị trường đơn giản, Realised Cap tổng hợp giá trị của mỗi coin tại thời điểm giao dịch cuối cùng của nó, cung cấp một cái nhìn thực tế hơn về vốn bị khóa trong mạng lưới.

Để so sánh: nếu một công ty kiếm được 1 đô la mỗi giây, thì sẽ mất 31 710 năm để tích lũy một triệu triệu đô la.

Bạn nghĩ điều này có ý nghĩa gì cho chu kỳ tăng trưởng tiếp theo của Bitcoin?

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

Thị trường châu Âu dự kiến sẽ mở cửa cao hơn: Euro Stoxx 50 và Stoxx 600 tương lai tăng 0,8% trong giao dịch trước thị trường khi những lo ngại về lập trường của chủ tịch Fed dịu lại và Trung Quốc xác nhận nỗ lực bình thường hóa quan hệ với EU trước thượng đỉnh.

Các nhà đầu tư tiếp tục theo dõi rủi ro thương mại khi Mỹ sẽ áp đặt thuế quan 30% đối với hàng nhập khẩu từ EU bắt đầu từ ngày 1 tháng 8 và chờ đợi báo cáo thu nhập từ ABB, Novartis, Investor AB, Volvo, Assa Abloy, SSE, Swedbank, TSMC, Publicis và EasyJet cũng như dữ liệu việc làm của Vương quốc Anh.

Các nhà đầu tư tiếp tục theo dõi rủi ro thương mại khi Mỹ sẽ áp đặt thuế quan 30% đối với hàng nhập khẩu từ EU bắt đầu từ ngày 1 tháng 8 và chờ đợi báo cáo thu nhập từ ABB, Novartis, Investor AB, Volvo, Assa Abloy, SSE, Swedbank, TSMC, Publicis và EasyJet cũng như dữ liệu việc làm của Vương quốc Anh.

AB1.21%

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

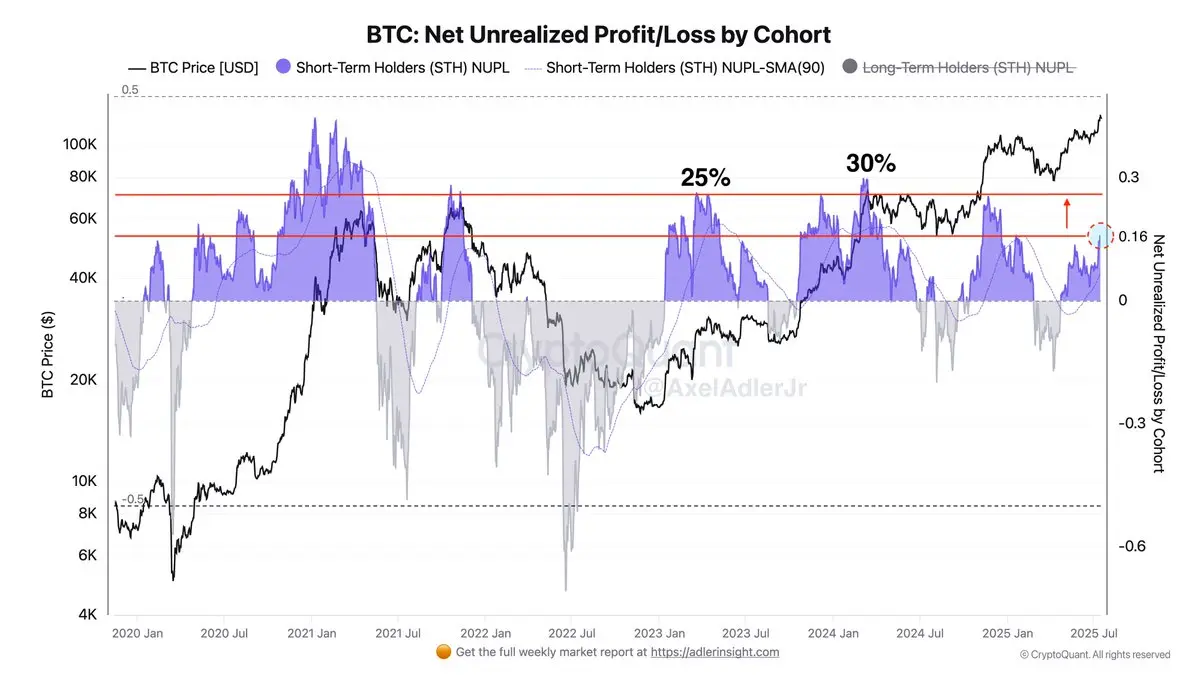

Trong các chu kỳ vĩ mô trước đây, chỉ số STH NUPL ở mức 25% trùng với đỉnh cao của sự phấn khích đầu cơ trong số các holder thời gian ngắn: họ bắt đầu thu lợi nhuận một cách ồ ạt, điều này đã kìm hãm hoặc đảo ngược đà tăng giá.

Hôm nay, tính đến ngày 17 tháng 7 năm 2025, STH NUPL đứng ở mức 13% ( so với 16% ở mức ATH cuối cùng ), cho thấy lợi nhuận chưa thực hiện ở mức vừa phải trong nhóm này và không có dấu hiệu nào của sự quá nóng trên thị trường.

Để tỷ lệ lợi nhuận chưa thực hiện tăng lên 25%, giá BTC hiện tại phải vượt qua mức 137K đô la. Mức này sẽ là yếu tố kích hoạt cho việc bán tháo hà

Xem bản gốcHôm nay, tính đến ngày 17 tháng 7 năm 2025, STH NUPL đứng ở mức 13% ( so với 16% ở mức ATH cuối cùng ), cho thấy lợi nhuận chưa thực hiện ở mức vừa phải trong nhóm này và không có dấu hiệu nào của sự quá nóng trên thị trường.

Để tỷ lệ lợi nhuận chưa thực hiện tăng lên 25%, giá BTC hiện tại phải vượt qua mức 137K đô la. Mức này sẽ là yếu tố kích hoạt cho việc bán tháo hà

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ

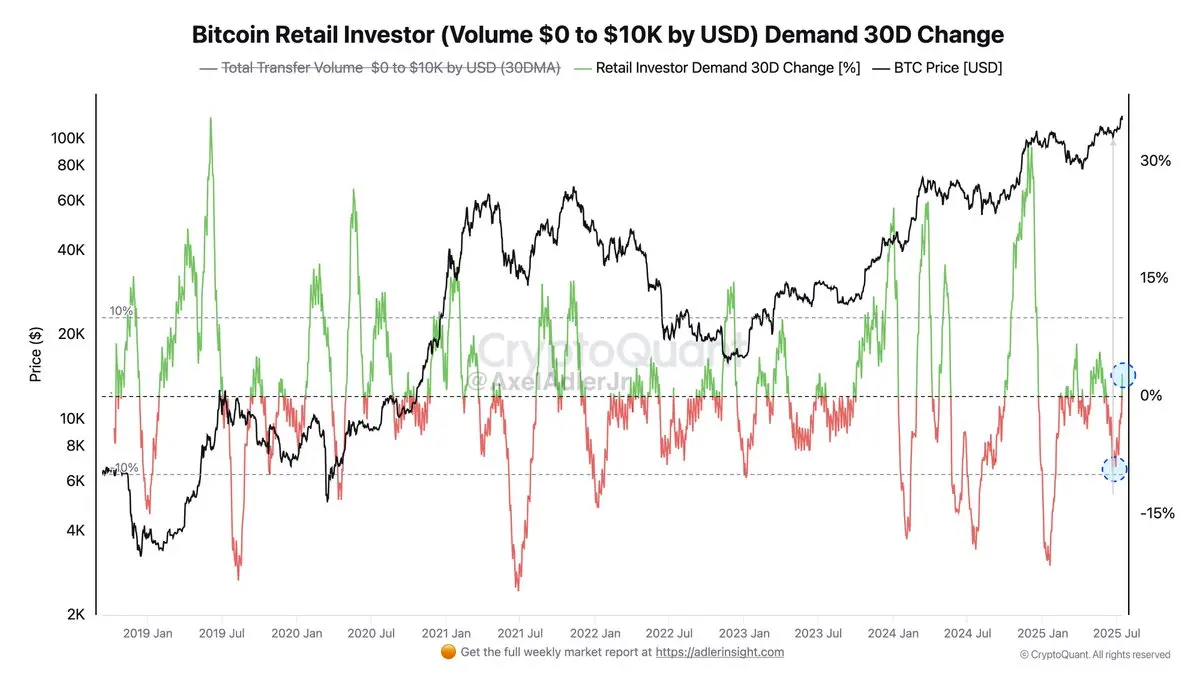

Nhà đầu tư bán lẻ đang trở lại.

Sự thay đổi trong 30 ngày về nhu cầu cho các khối lượng chuyển tiền nhỏ ($0–$10K) đã thoát khỏi vùng tiêu cực trong tuần qua.

Sự thay đổi trong 30 ngày về nhu cầu cho các khối lượng chuyển tiền nhỏ ($0–$10K) đã thoát khỏi vùng tiêu cực trong tuần qua.

OVER1.69%

- Phần thưởng

- Thích

- Bình luận

- Chia sẻ