DtDt666

No content yet

DtDt666

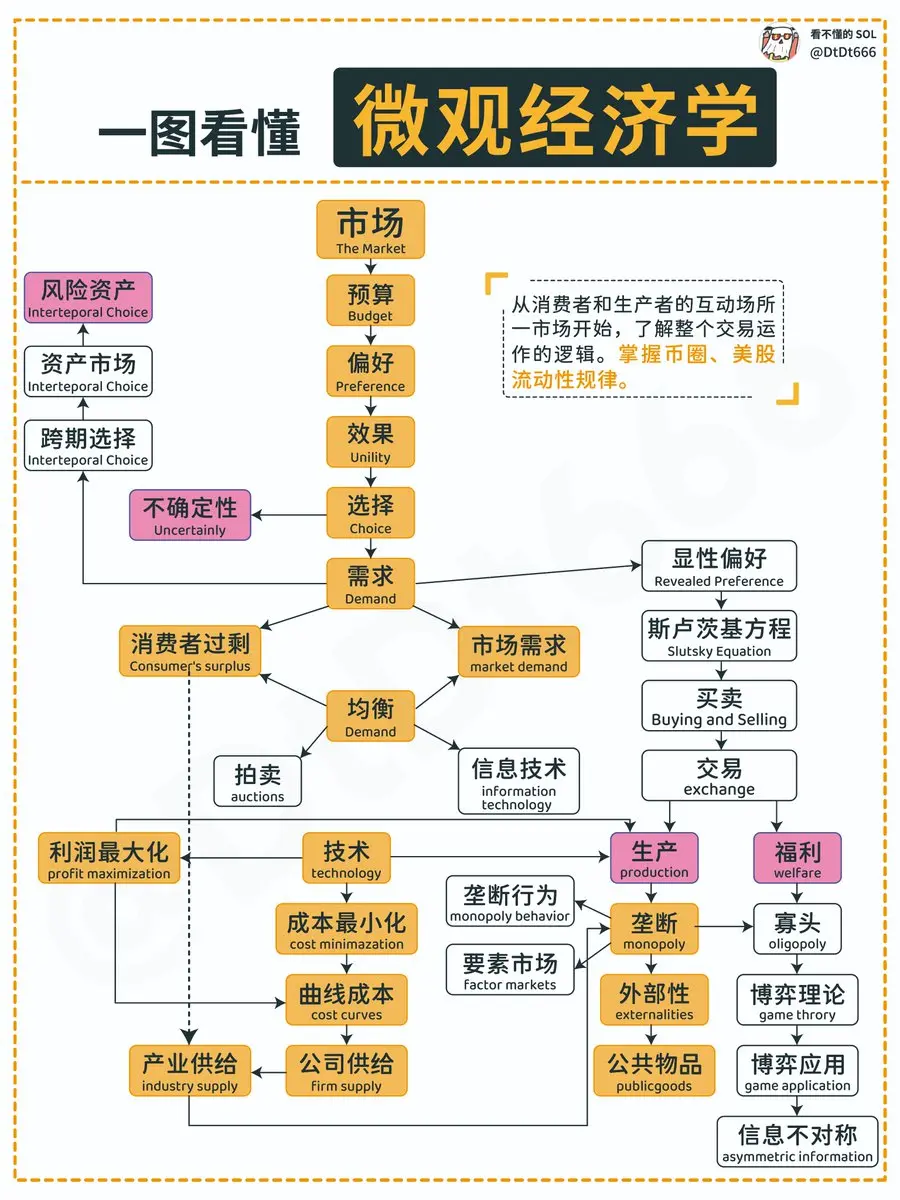

Understand microeconomics in one picture! !️

Why do I suggest that everyone play the currency circle, it is necessary to understand the basic logic of finance and economics?

Understand the basic logic of finance, pay less tuition, and earn more cognitive money.

The sharp rise and fall of the currency circle is not metaphysics, but also the logical embodiment of microeconomics!

To understand this, you are no longer "stud by feeling", but use rules to predict trends and control risks.

View OriginalWhy do I suggest that everyone play the currency circle, it is necessary to understand the basic logic of finance and economics?

Understand the basic logic of finance, pay less tuition, and earn more cognitive money.

The sharp rise and fall of the currency circle is not metaphysics, but also the logical embodiment of microeconomics!

To understand this, you are no longer "stud by feeling", but use rules to predict trends and control risks.

- Reward

- like

- Comment

- Share

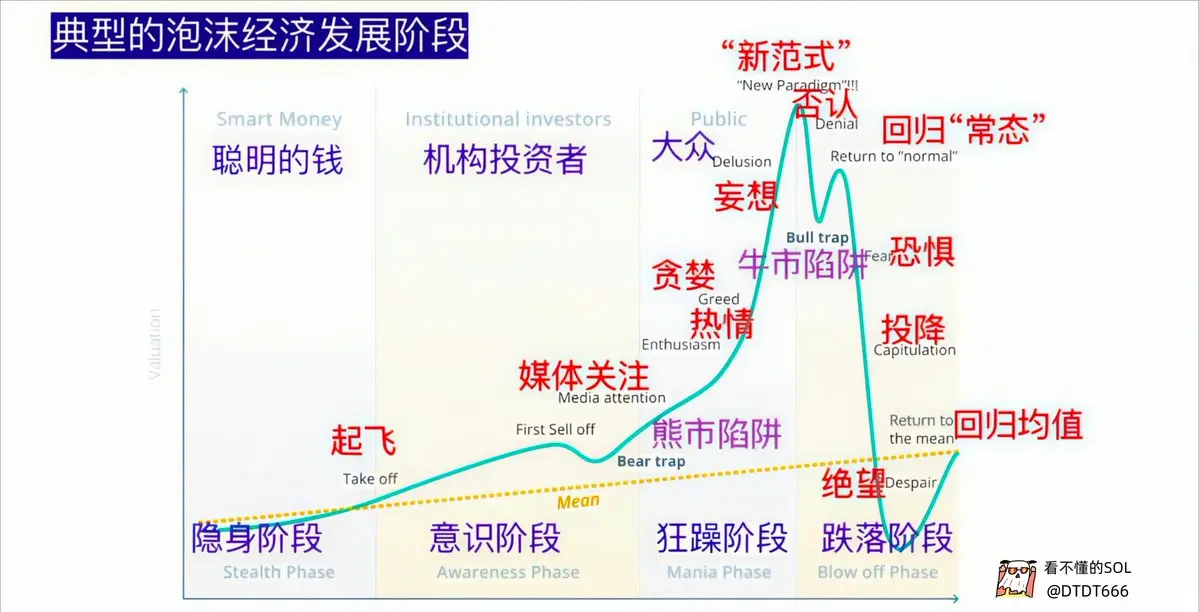

It's time to test your vision! Brothers, do you think the current market is building:

✅ Bear market trap - the gold pit has appeared, and it is a good opportunity to lay out in batches

✅ Bull trap - the rally is over, decisively reduce positions and avoid risks

View Original✅ Bear market trap - the gold pit has appeared, and it is a good opportunity to lay out in batches

✅ Bull trap - the rally is over, decisively reduce positions and avoid risks

- Reward

- like

- Comment

- Share

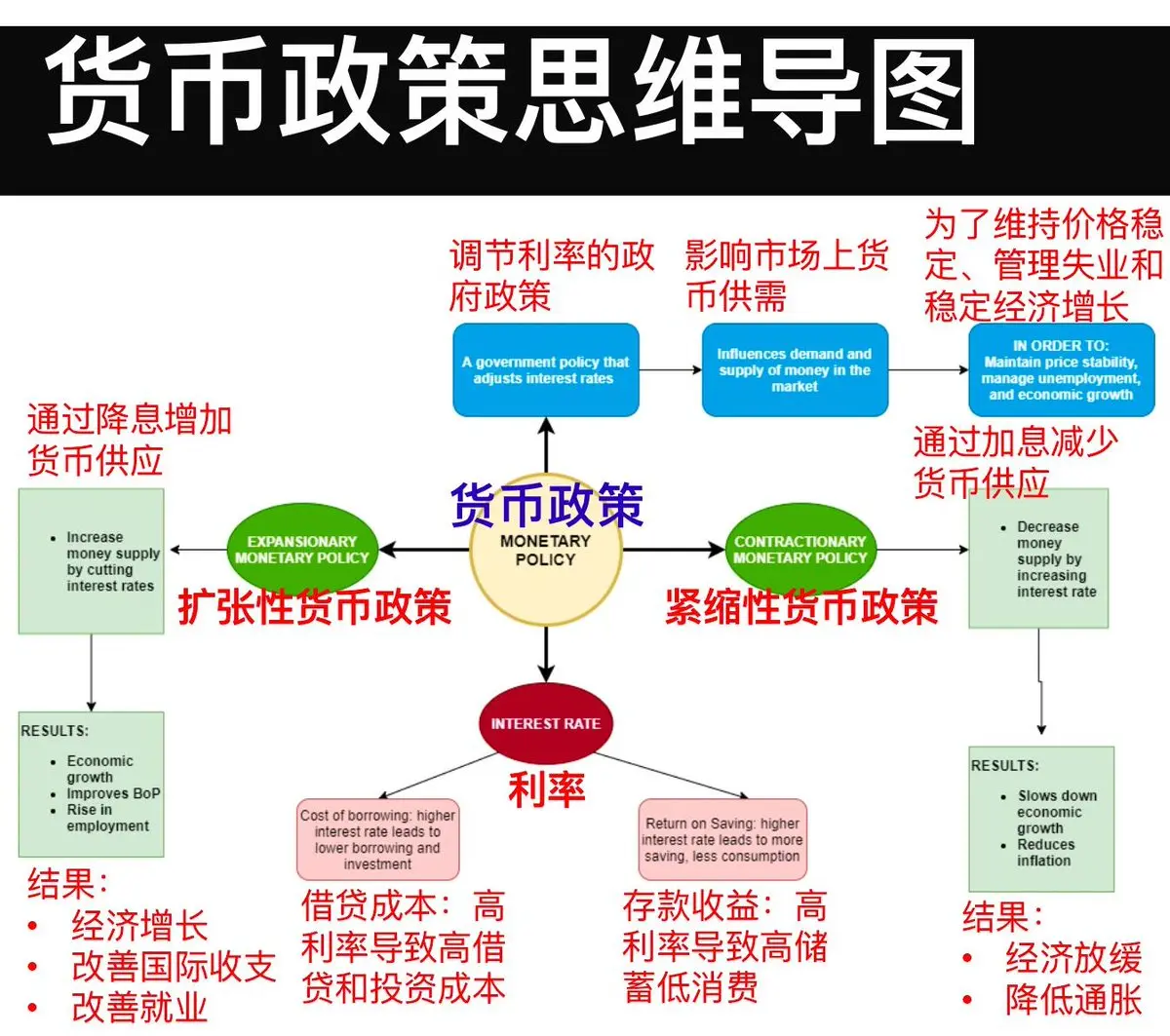

A diagram to understand the basic logic of monetary policy interest rate cuts/interest rate hikes

Interest rate cuts are the most direct factors that provide liquidity for the currency circle and U.S. stocks.

For a better understanding of the brothers, this diagram is supplemented.

Interest rate cuts stimulate investment and consumption by reducing financing costs→ release liquid→ity→ stimulate investment and consumption and push up the price of risky assets (stocks/currency circles)

Raising interest rates raises the price of funds→ shrinks liquidity→ curbs inflation, overheated → suppresses a

View OriginalInterest rate cuts are the most direct factors that provide liquidity for the currency circle and U.S. stocks.

For a better understanding of the brothers, this diagram is supplemented.

Interest rate cuts stimulate investment and consumption by reducing financing costs→ release liquid→ity→ stimulate investment and consumption and push up the price of risky assets (stocks/currency circles)

Raising interest rates raises the price of funds→ shrinks liquidity→ curbs inflation, overheated → suppresses a

- Reward

- like

- Comment

- Share

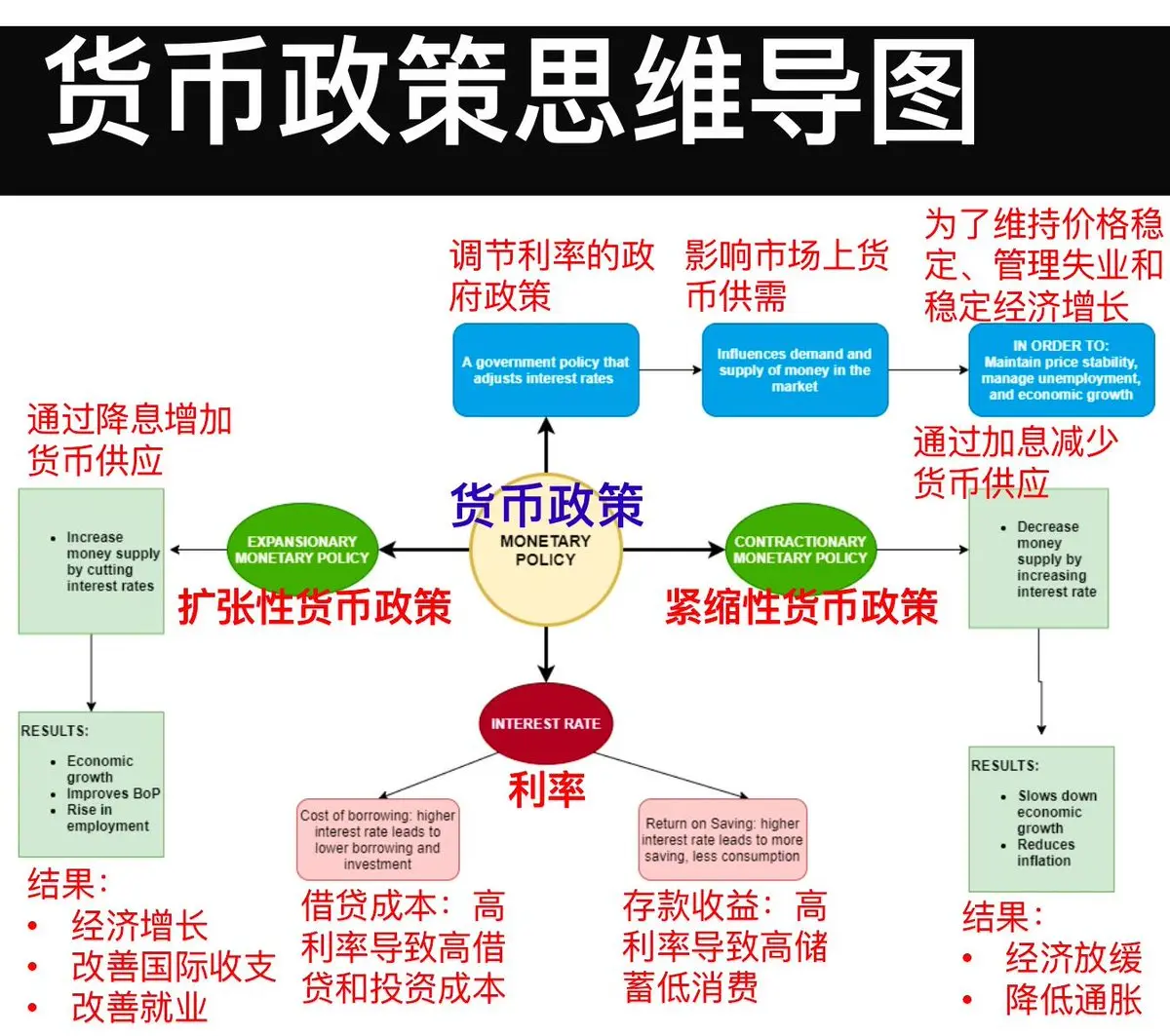

A diagram to understand the basic logic of monetary policy interest rate cuts/interest rate hikes

The interest rate cut is the most direct factor influencing the liquidity for the currency circle and U.S. stocks?

For a better understanding of the brothers, this diagram is supplemented.

Interest rate cuts stimulate investment and consumption by reducing financing costs→ release liquid→ity→ stimulate investment and consumption and push up the price of risky assets (stocks/currency circles)

Raising interest rates raises the price of funds→ shrinks liquidity→ curbs inflation, overheated → suppress

View OriginalThe interest rate cut is the most direct factor influencing the liquidity for the currency circle and U.S. stocks?

For a better understanding of the brothers, this diagram is supplemented.

Interest rate cuts stimulate investment and consumption by reducing financing costs→ release liquid→ity→ stimulate investment and consumption and push up the price of risky assets (stocks/currency circles)

Raising interest rates raises the price of funds→ shrinks liquidity→ curbs inflation, overheated → suppress

- Reward

- like

- Comment

- Share

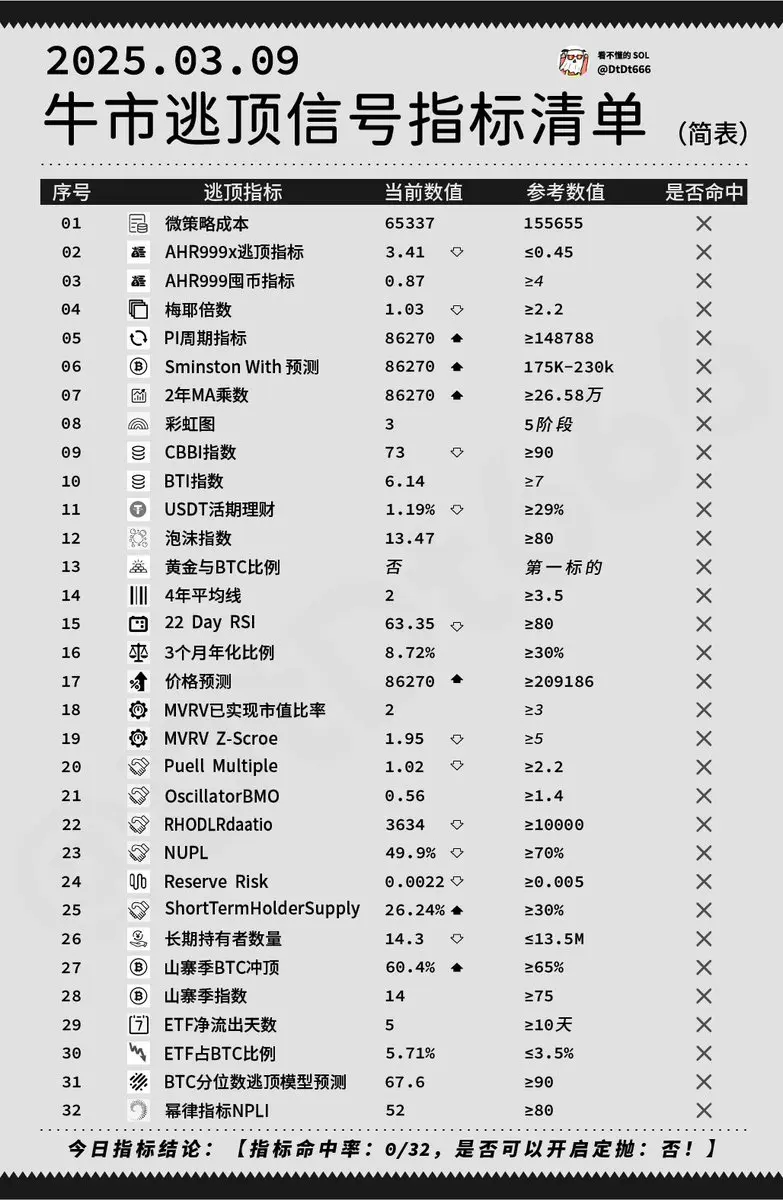

are permeated with a sense of conclusive closure of the coffin,

It is determined that this round of bull market has completely ended,

All the tailwinds have settled.

The market started to fall, liquidity gradually dried up, and everyone sighed, believing that the bear market was coming...

But don't forget,

The whole network chanting "the end of the bull market" is more neat,

The more piercing the sound of chip delivery behind the candlestick.

The capital market will always complete the transfer of wealth in the strangulation consensus, and when all leeks learn to "good landing is negative", hu

View OriginalIt is determined that this round of bull market has completely ended,

All the tailwinds have settled.

The market started to fall, liquidity gradually dried up, and everyone sighed, believing that the bear market was coming...

But don't forget,

The whole network chanting "the end of the bull market" is more neat,

The more piercing the sound of chip delivery behind the candlestick.

The capital market will always complete the transfer of wealth in the strangulation consensus, and when all leeks learn to "good landing is negative", hu

- Reward

- like

- Comment

- Share

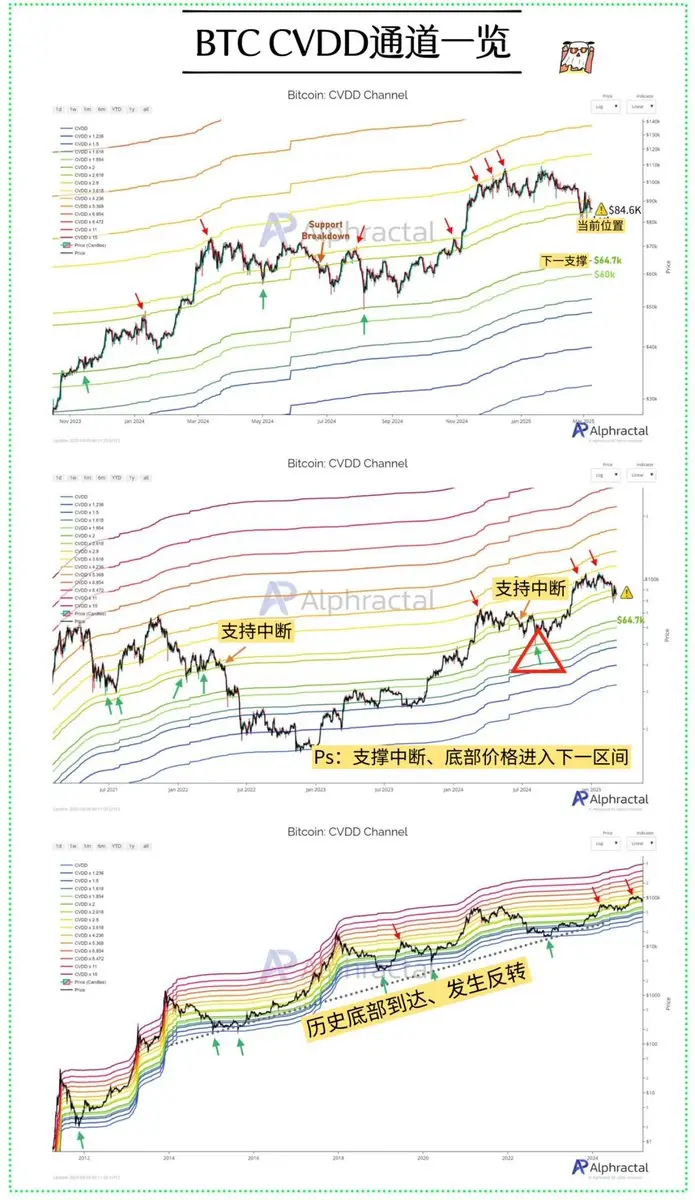

Judging from the on-chain data, it is still relatively uncomfortable at present, Bitcoin must hold on to 84,000, and once it fails, it may trigger a plunge mode!

The indicator shows that the current currency price is facing the life and death line - CVDD× 2.618 Fibonacci extension (current price 84640 dollars) According to the analysis of the indicator model:

✅ Stand firm and take off: As long as the bottom is completed above 84000, the main rising wave will most likely start on the eve of the interest rate cut.

❌ If it falls below it, it will be bloody: if it closes below 84,000 for 5-7 conse

The indicator shows that the current currency price is facing the life and death line - CVDD× 2.618 Fibonacci extension (current price 84640 dollars) According to the analysis of the indicator model:

✅ Stand firm and take off: As long as the bottom is completed above 84000, the main rising wave will most likely start on the eve of the interest rate cut.

❌ If it falls below it, it will be bloody: if it closes below 84,000 for 5-7 conse

BTC0.06%

- Reward

- like

- 1

- Share

HappyNewYear :

:

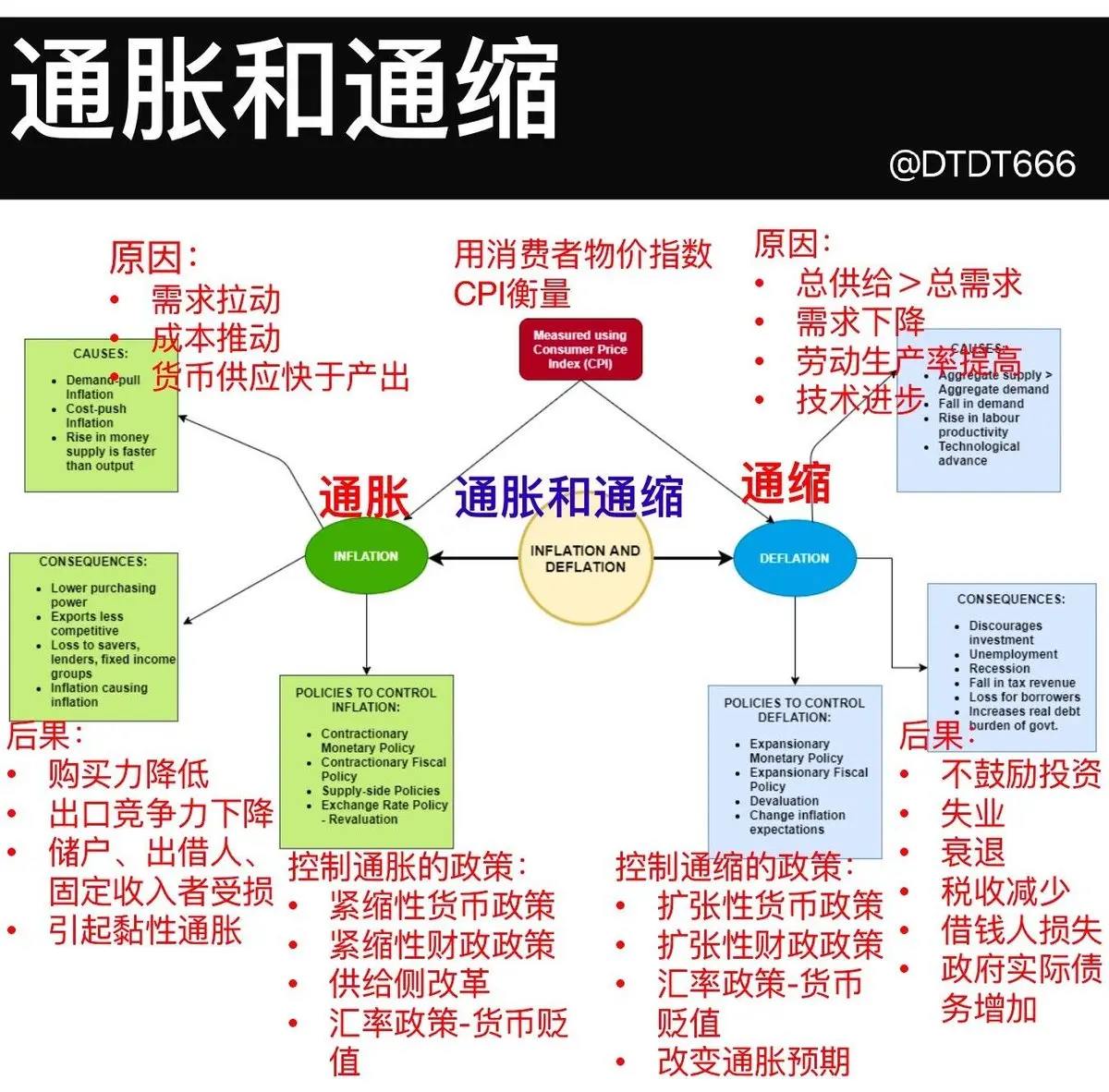

Recently, everyone's view on Bitcoin is optimistic. It is believed that Bitcoin has been continuously declining, breaking through all key support areas, and is currently in a strong bearish trend. A retracement is currently underway.A diagram to understand the basic logic of inflation and deflation

For a better understanding of my brothers, I would like to add this chart to understand the liquidity impact of the monetary policy determined by inflation and deflation on the currency circle and U.S. stocks.

View OriginalFor a better understanding of my brothers, I would like to add this chart to understand the liquidity impact of the monetary policy determined by inflation and deflation on the currency circle and U.S. stocks.

- Reward

- like

- Comment

- Share

Understanding the Ten Principles of Economics in One Picture (Vernacular)

Many brothers think that they can conquer the currency circle by relying on "stud faith"?

Don't understand the opportunity cost, every time you are all-in, you are paving the way for someone else's financial freedom

Regardless of the marginal risk, the moment of increasing leverage, it is destined to become charity fuel for the exchange

Ignoring market supply and demand, chasing up and down is just a leek's standard posture of handing a knife to the dealer

Sometimes you can't even figure out the principle of inflation,

View OriginalMany brothers think that they can conquer the currency circle by relying on "stud faith"?

Don't understand the opportunity cost, every time you are all-in, you are paving the way for someone else's financial freedom

Regardless of the marginal risk, the moment of increasing leverage, it is destined to become charity fuel for the exchange

Ignoring market supply and demand, chasing up and down is just a leek's standard posture of handing a knife to the dealer

Sometimes you can't even figure out the principle of inflation,

- Reward

- like

- Comment

- Share

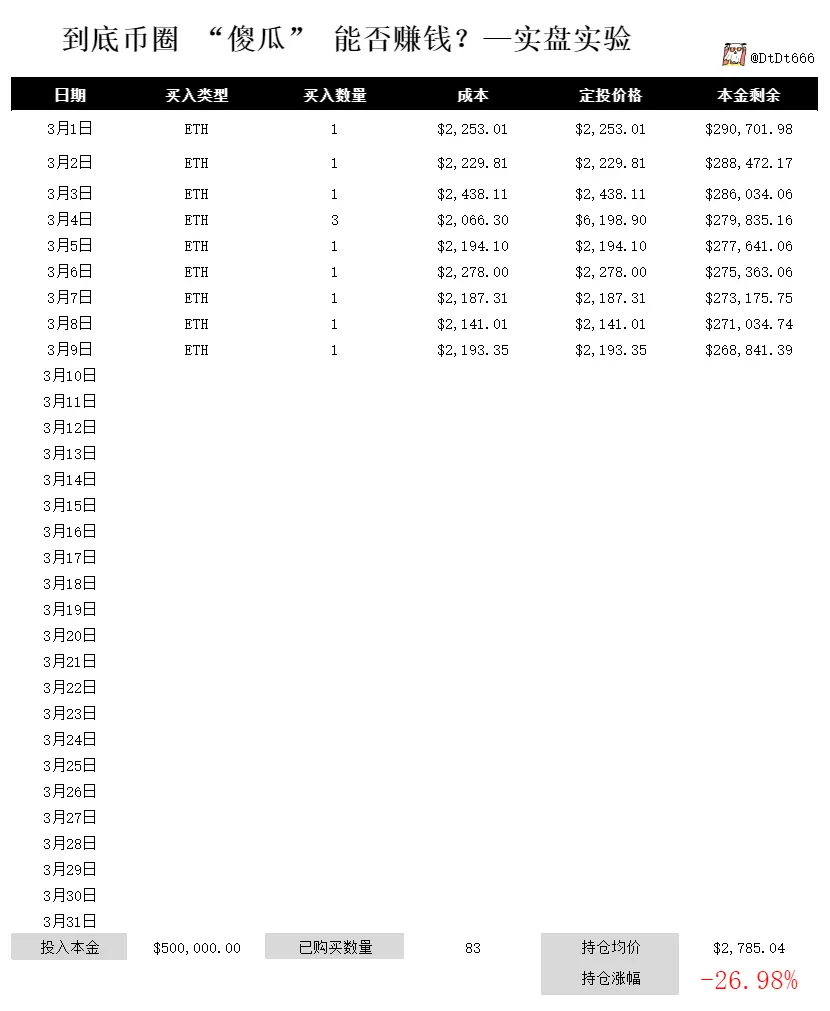

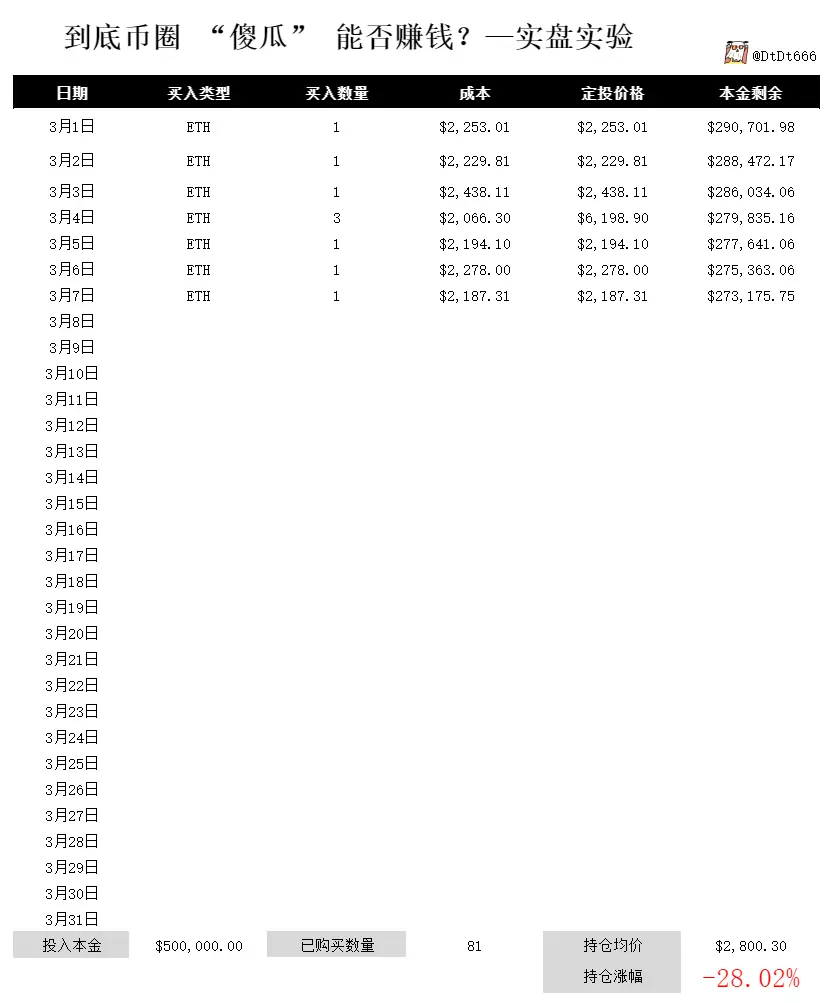

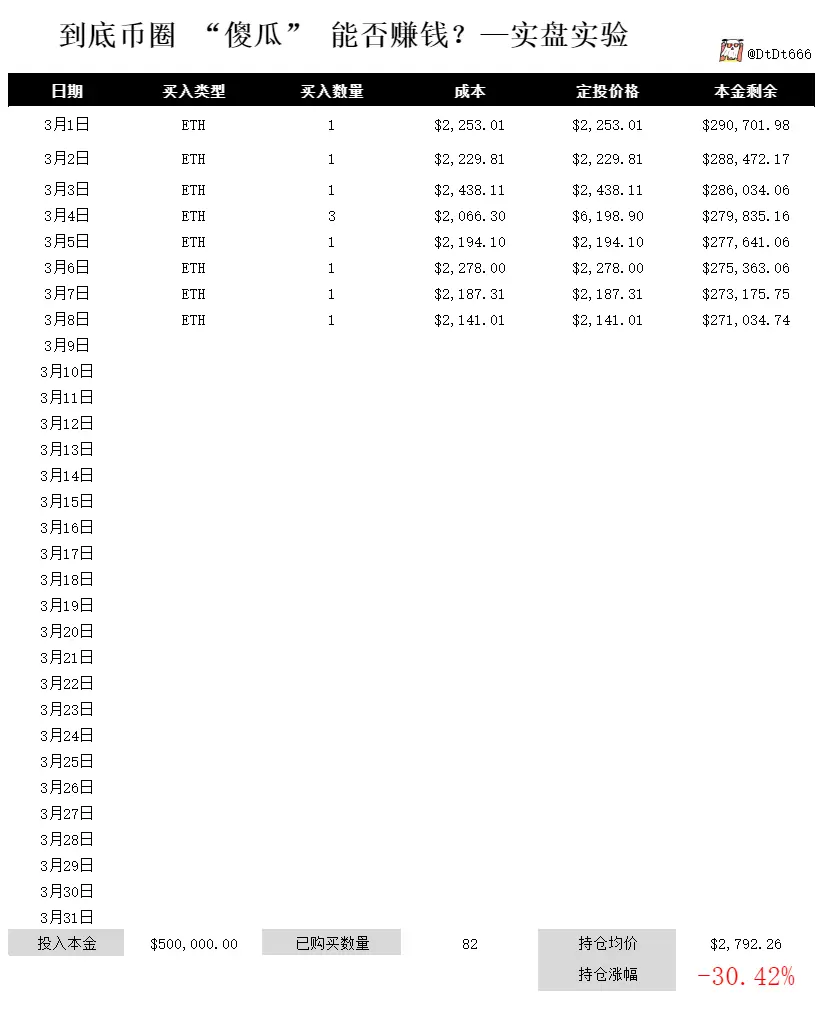

The indicator is normal, and I continue to buy 1 ETH without brains

At present, the total cost is 228965.26U

A total of 82 ETH have been bought

The current total amount of ETH is 175562.82U

Floating loss: -53402.44U

It's about to lose one, Xiaomi SU7 Ultra

Will this foolish experiment of the brothers create a myth, or will they lose when they choose ETH at the beginning?

View OriginalAt present, the total cost is 228965.26U

A total of 82 ETH have been bought

The current total amount of ETH is 175562.82U

Floating loss: -53402.44U

It's about to lose one, Xiaomi SU7 Ultra

Will this foolish experiment of the brothers create a myth, or will they lose when they choose ETH at the beginning?

- Reward

- like

- Comment

- Share

A picture is worth a thousand words! What did the White House encryption industry summit really talk about?

Top ten core points summary

1️⃣Trump reiterated his support for encryption currency in his opening speech

2️⃣Stablecoin legislation becomes a top priority, aiming to clarify the regulatory framework for digital assets before the August congressional recess.

3️⃣The government emphasizes that the United States should maintain its global financial leadership, and stablecoins will play a key role in this vision.

4️⃣Trump calls for ending the 'ban action 2.0' to loosen the restrictions on enc

View OriginalTop ten core points summary

1️⃣Trump reiterated his support for encryption currency in his opening speech

2️⃣Stablecoin legislation becomes a top priority, aiming to clarify the regulatory framework for digital assets before the August congressional recess.

3️⃣The government emphasizes that the United States should maintain its global financial leadership, and stablecoins will play a key role in this vision.

4️⃣Trump calls for ending the 'ban action 2.0' to loosen the restrictions on enc

- Reward

- like

- Comment

- Share

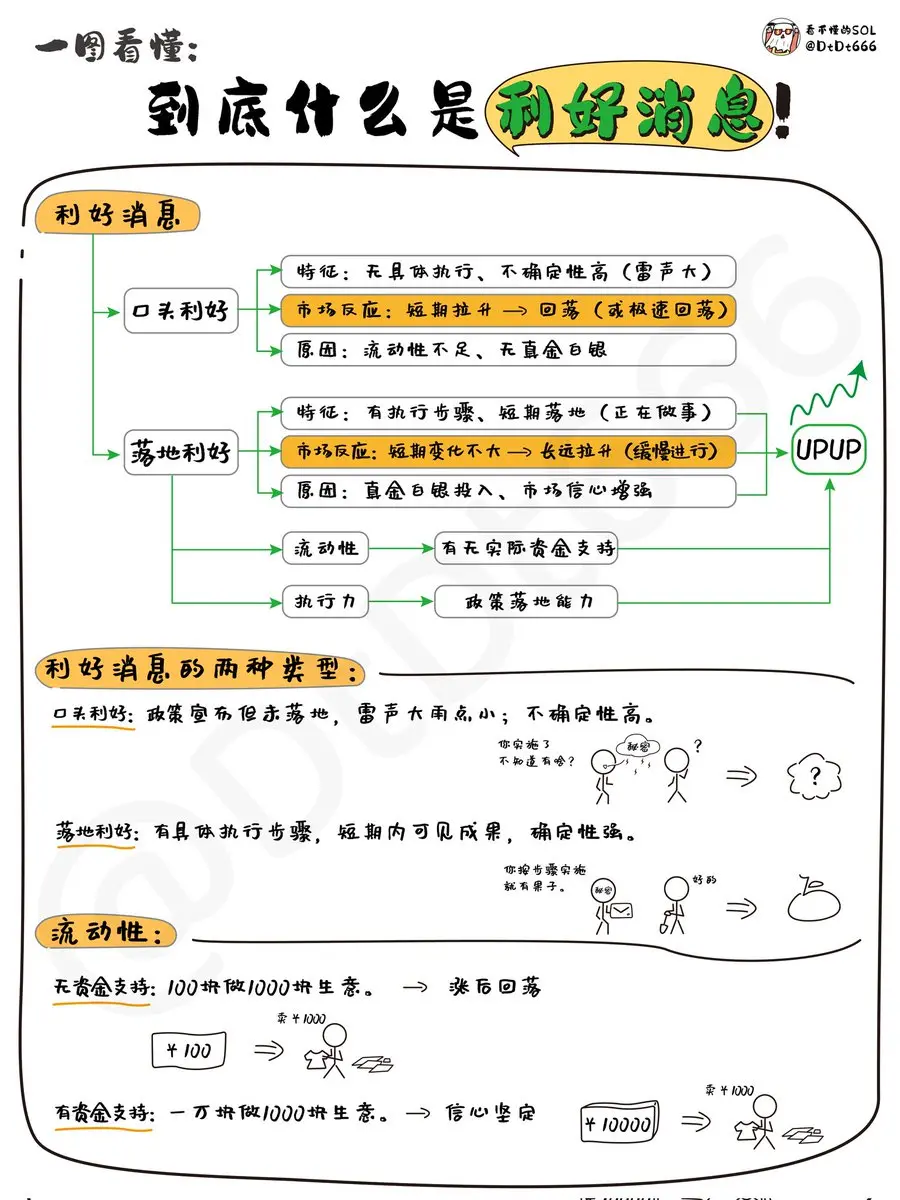

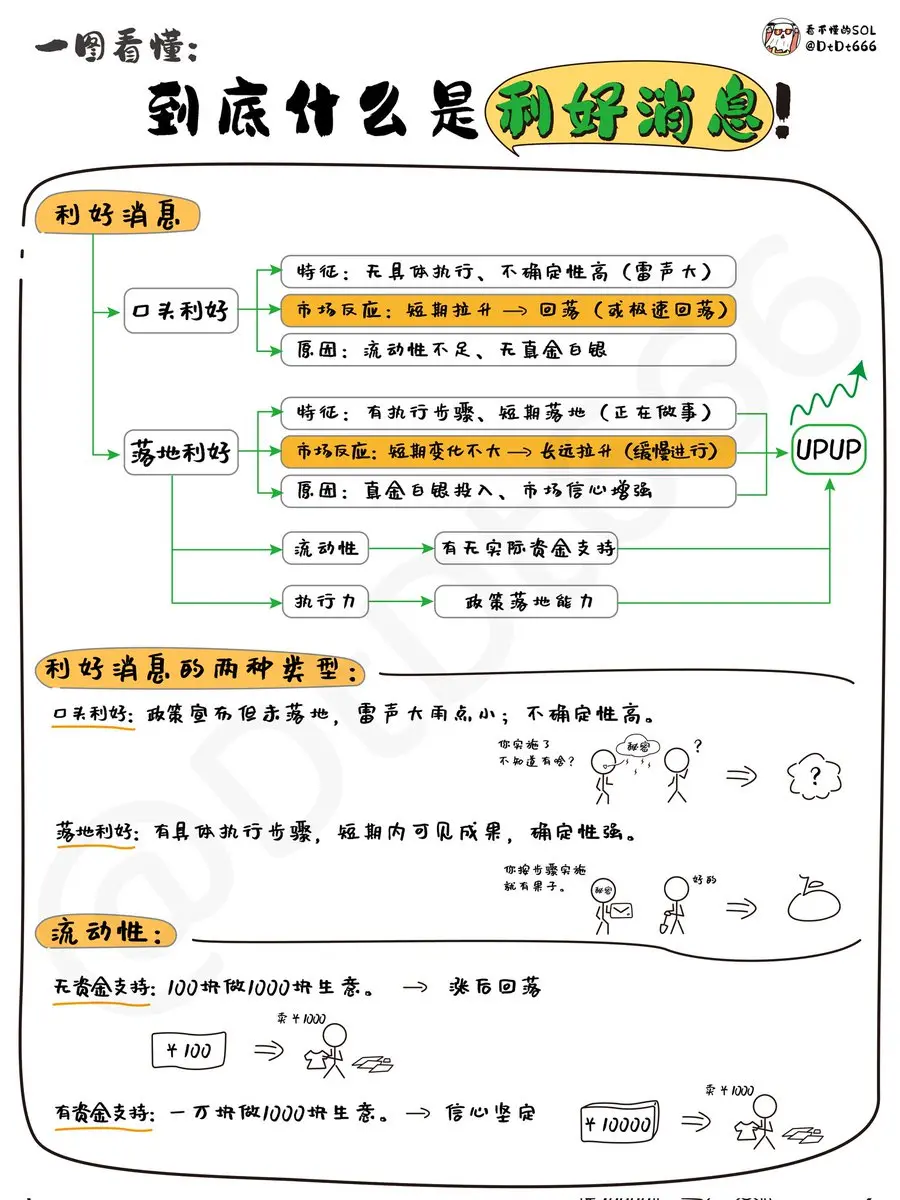

Many brothers are puzzled, why sometimes the market falls even though it is clearly TM's Favourable Information.

Actually, this Favourable Information depends on what Favourable Information it is:

🔶Policy statements of Favourable Information are often accompanied by thunderous announcements, but the specific implementation, who will implement it, what the timeline looks like, how to ensure successful implementation, all of these are unknown.

🔶Policy implementation Favourable Information, with specific implementation steps, and will be implemented in the short term, or has been implemented, i

Actually, this Favourable Information depends on what Favourable Information it is:

🔶Policy statements of Favourable Information are often accompanied by thunderous announcements, but the specific implementation, who will implement it, what the timeline looks like, how to ensure successful implementation, all of these are unknown.

🔶Policy implementation Favourable Information, with specific implementation steps, and will be implemented in the short term, or has been implemented, i

TRUMP2.11%

- Reward

- like

- Comment

- Share

Many brothers are puzzled, why sometimes when it is clearly Favourable Information, the market will instead fall?

Actually, this Favourable Information depends on what kind of Favourable Information it is:

🔶Policy signals Favourable Information is often loud, but whether it will be implemented, how it will be implemented, who will implement it, what the timeline will be, and how to ensure implementation are all unknown.

🔶Policy implementation Favourable Information, with specific execution steps, and will be implemented in the short term, or has been implemented, it is obvious to the discern

Actually, this Favourable Information depends on what kind of Favourable Information it is:

🔶Policy signals Favourable Information is often loud, but whether it will be implemented, how it will be implemented, who will implement it, what the timeline will be, and how to ensure implementation are all unknown.

🔶Policy implementation Favourable Information, with specific execution steps, and will be implemented in the short term, or has been implemented, it is obvious to the discern

TRUMP2.11%

- Reward

- like

- Comment

- Share

A brother asked me what is VISA's profit model?

For a better understanding of the brothers

I directly created a popular science video

View OriginalFor a better understanding of the brothers

I directly created a popular science video

- Reward

- like

- Comment

- Share

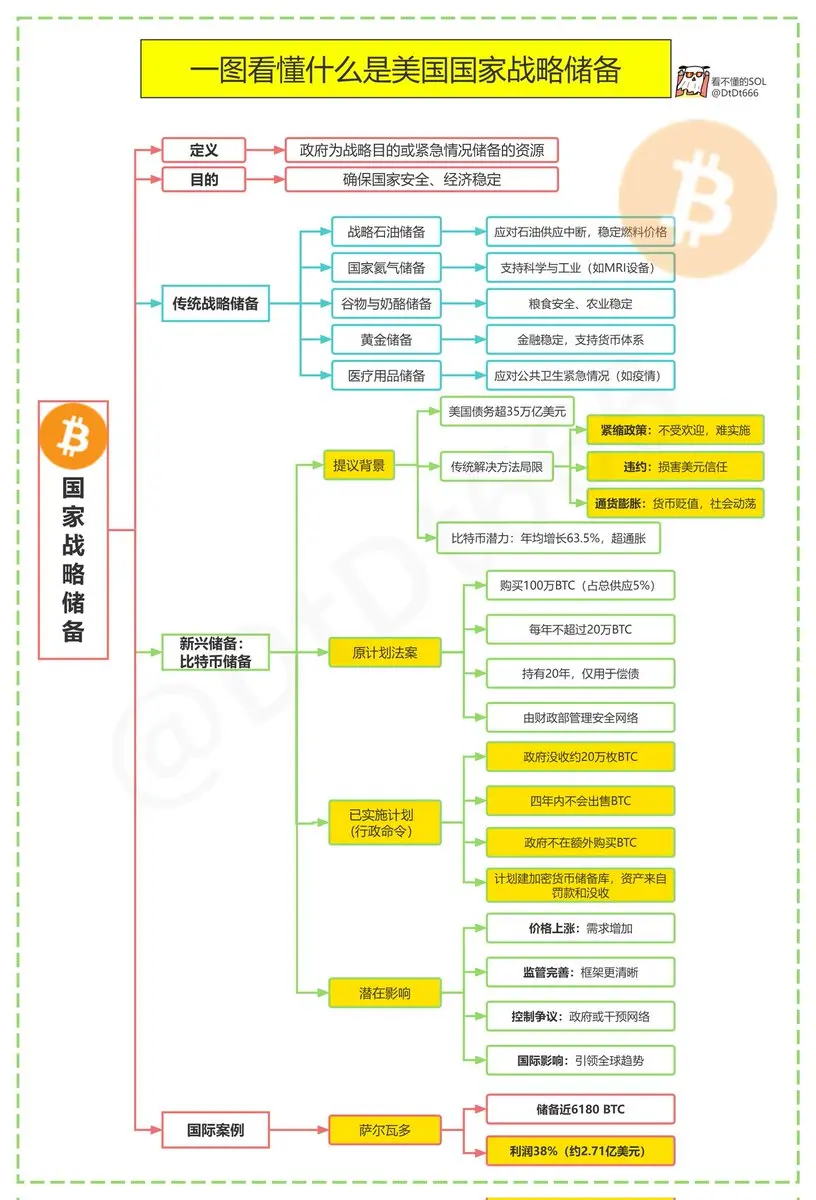

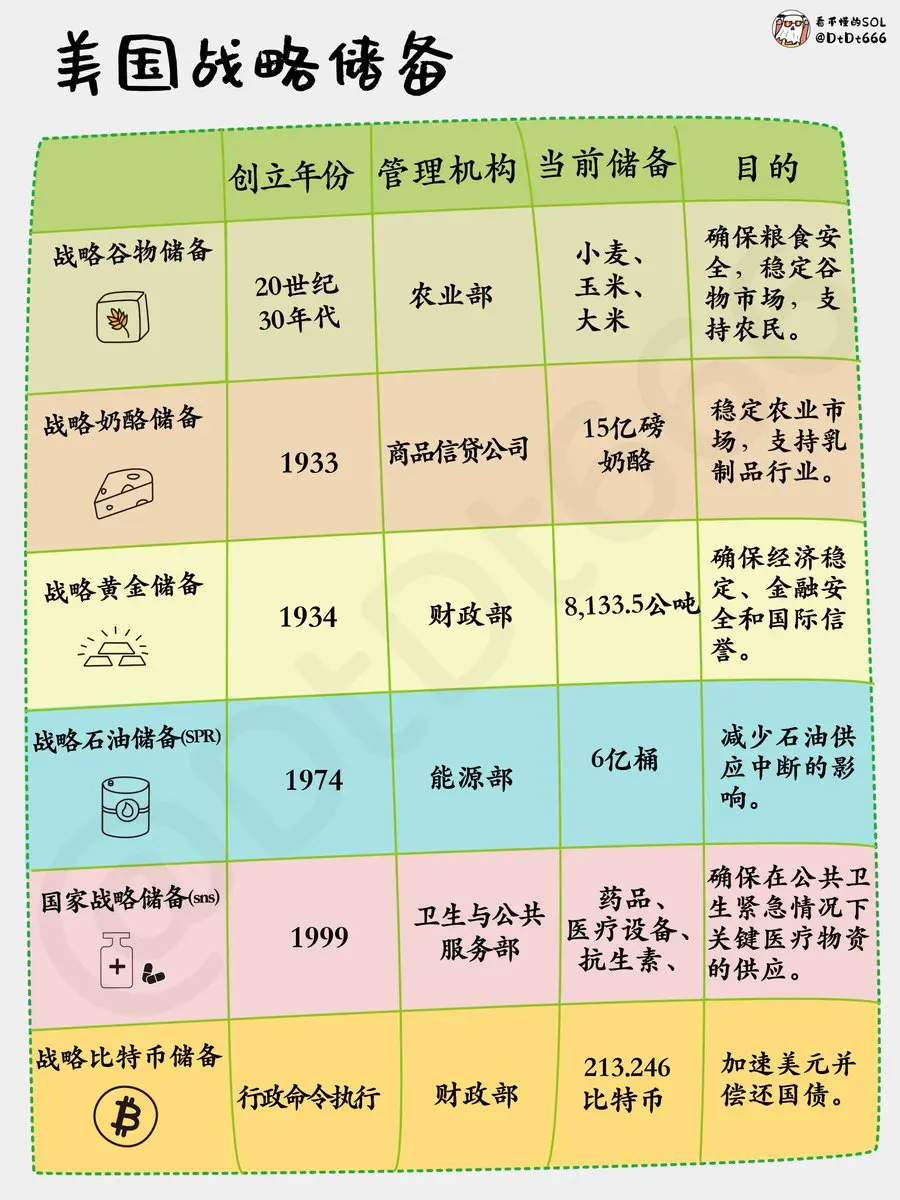

A visual look at Bitcoin's strategic reserves, how amazing is it?

The leeks are still entangled in the ups and downs of those trivial matters.

What is 1️⃣ strategic reserve?

Strategic reserves refer to the planned storage system of key materials that the government reserves for special strategic needs or emergencies.

Since World War II, the United States has established multiple strategic reserves, covering key areas such as oil, food, precious metals, and medicines. It is now officially incorporating Bitcoin into its strategic reserve system.

2️⃣ Central Bank Reserves

The Fed also holds a var

View OriginalThe leeks are still entangled in the ups and downs of those trivial matters.

What is 1️⃣ strategic reserve?

Strategic reserves refer to the planned storage system of key materials that the government reserves for special strategic needs or emergencies.

Since World War II, the United States has established multiple strategic reserves, covering key areas such as oil, food, precious metals, and medicines. It is now officially incorporating Bitcoin into its strategic reserve system.

2️⃣ Central Bank Reserves

The Fed also holds a var

- Reward

- like

- Comment

- Share

Yesterday we also talked about this topic. Trump is a businessman, seeking to maximize profits in all aspects.

Without spending a penny, without buying new BTC, confiscate 200,000 BTC directly for 'nationalization', the world's largest cold wallet gets a free ride.

Never sell, the national machine certifies it as "ultimate scarcity", giving Bitcoin a gold status in disguise.

Enforcement turning into mining machines, confiscating black market coins = fiscal revenue creation, cracking down on crime unexpectedly becomes a new mining model in the United States.

Still the same old saying: the more

View OriginalWithout spending a penny, without buying new BTC, confiscate 200,000 BTC directly for 'nationalization', the world's largest cold wallet gets a free ride.

Never sell, the national machine certifies it as "ultimate scarcity", giving Bitcoin a gold status in disguise.

Enforcement turning into mining machines, confiscating black market coins = fiscal revenue creation, cracking down on crime unexpectedly becomes a new mining model in the United States.

Still the same old saying: the more

- Reward

- like

- Comment

- Share