Articles

AllAltcoinsBitcoinBlockchainDeFiEthereumMetaverseNFTsTradingTutorialFuturesTrading BotsBRC-20GameFiDAOMacro TrendsWalletsInscriptionTechnologyMemeAISocialFiDePinStableCoinLiquid StakingFinanceRWAModular BlockchainsZero-Knowledge ProofRestakingCrypto ToolsAirdropGate ProductsSecurityProject AnalysisCryptoPulseResearchTON EcosystemLayer 2SolanaPaymentsMiningHot TopicsP2PSui EcosystemChain AbstractionOptionQuick ReadsVideoDaily ReportMarket ForecastTrading BotsVIP Industry Report

More

Lesson 2

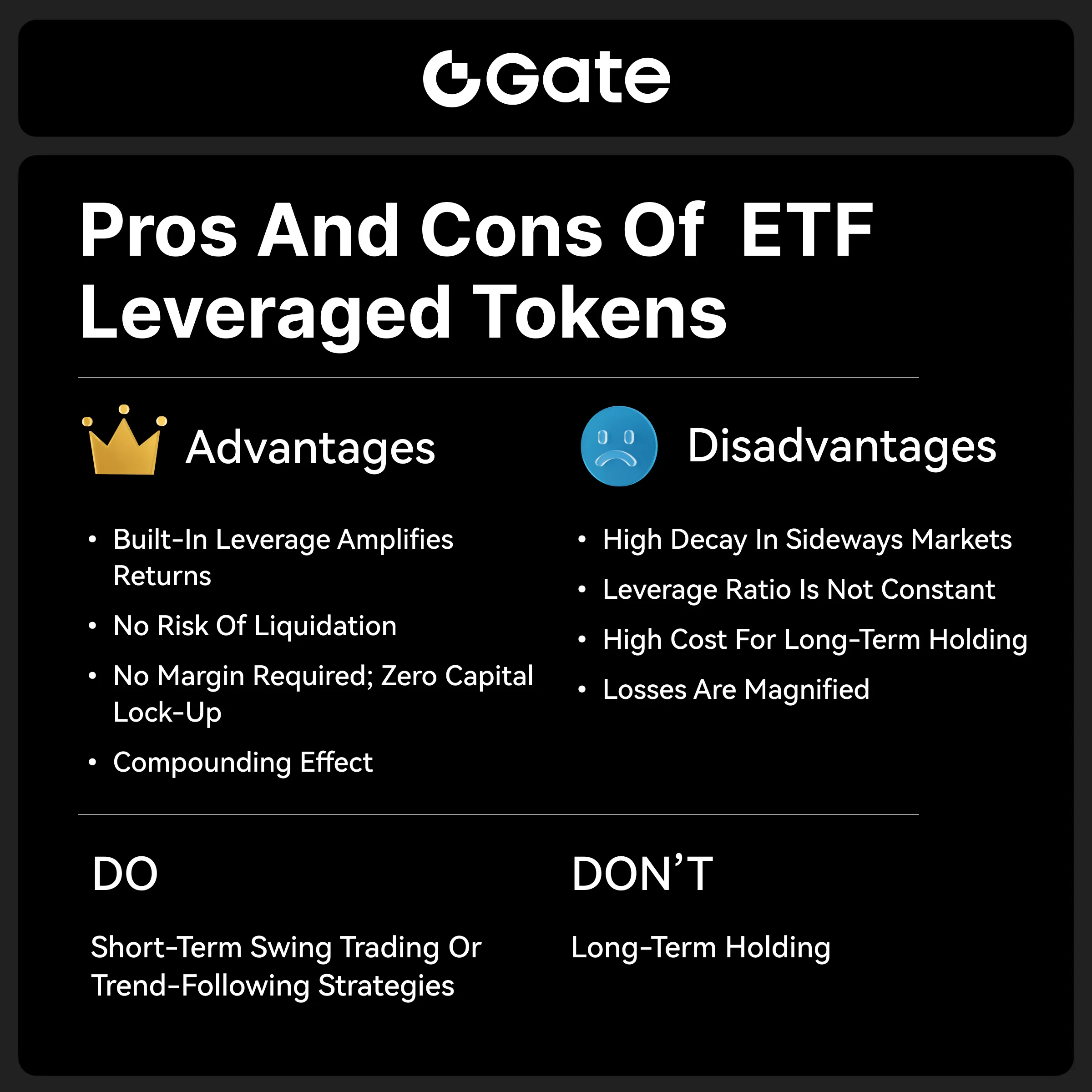

Pros and Cons of ETF Leveraged Tokens

Explore the advantages and risks of ETF leveraged tokens for informed trading decisions.

Advantages of ETF Leveraged Tokens

- Built-in Leverage: No margin required, no liquidation risk

- Auto-Rebalancing: Daily rebalancing to maintain target leverage

- Flexible Exposure: Both long and short leveraged tokens available — profit in either direction

- Transparent Fees: Only a management fee (typically 0.1% per day)

- User-Friendly: Trade like spot assets, no need to worry about forced liquidation

Disadvantages of ETF Leveraged Tokens

1. Leverage Risk

Leveraged tokens amplify the price movements of the underlying asset through financial derivatives (such as perpetual contracts and futures). This means:

- Amplified Gains: When the underlying asset price increases, the token’s return is magnified.

- Amplified Losses: When the underlying asset price decreases, the token’s loss is also magnified.

Example: If the underlying asset drops 10%:

- A 3x leveraged token may lose 30% in value

- A 5x leveraged token may lose 50% in value

2. High Volatility Decay — Not Suitable for Long-Term Holding

The net asset value (NAV) of leveraged tokens is highly sensitive to market volatility, especially during sharp price swings in the underlying asset.

Volatility decay refers to the phenomenon where, after the underlying asset first rises and then falls back (or vice versa), the leveraged token’s NAV ends up lower than its original value, even though the asset price returns to its starting point.

Disclaimer

* Crypto investment involves significant risks. Please proceed with caution. The course is not intended as investment advice.

* The course is created by the author who has joined Gate Learn. Any opinion shared by the author does not represent Gate Learn.

Catalog

Lesson 1:ETF Leveraged Tokens Introduction

03 min

1 enrolled

Lesson 2:Pros and Cons of ETF Leveraged Tokens

0 enrolled

Lesson 3:What market conditions are ETF leveraged Tokens suitable for?

0 enrolled

Lesson 4:How Do ETF Leveraged Tokens Differ from Spot, Margin, and Futures Trading?

0 enrolled

Lesson 5:How to trade ETF leveraged tokens?

0 enrolled